Alphacat, a robot advisor marketplace for cryptocurrency trading has published its final progress report for 2018. The update shares news from the Alphacat ecosystem and unveils two new features.

The newest additions to the platform are the Cryptocurrency Risk Analysis Bot (CRAB) and the ACE Top Index; both are claimed to be developed independently by the Alphacat team.

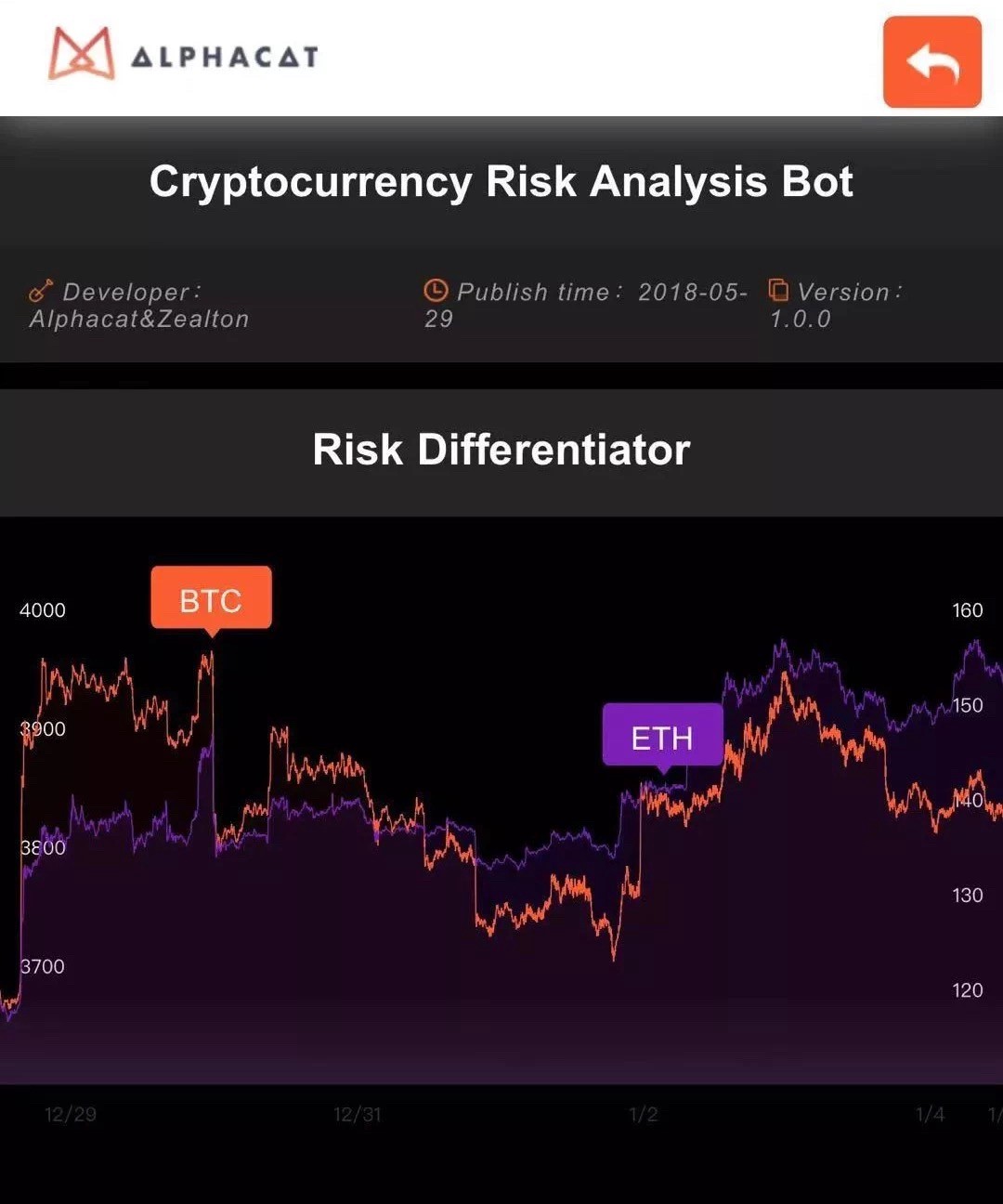

Cryptocurrency Risk Analysis Bot (CRAB)

CRAB analyses the relative risk profile of different cryptocurrencies, which Alphacat claims will allow traders to “cultivate a scientific and mature approach to investing.” Risk profiles are first established by analysing the historical trading data of different indexes. The data is then overlaid with technical indicators that measure the index’s volatility, momentum, volume, and other risk correlation factors.

In practice, the bot allows traders to visualize the risk of different cryptocurrency pairs as an additional indicator that can help them better manage their positions. The convergence and divergence (moving together or away) of the indicator lines also gives traders a feel for the general levels of risk in the market as well as the risk between specific coins.

If the lines converge in the same direction, this may indicate that no one coin is riskier than the other in the short-term. While divergences could indicate technical weakness, leading to a higher relative risk profile for one coin compared to another.

A screenshot of the feature in action can be seen below.

ACE Top Index

The platform’s second new feature, the ACE Top Index, is a weighted cryptocurrency index that represents the performance of the ten largest cryptocurrencies by market capitalization.

The index claims to be updated in real-time and reflects the aggregated value of the largest cryptocurrencies. Like with traditional stock market indexes such as S&P 500, cryptocurrency indexes let traders analyse the performance of specific coins against the trend of the market, along with their average price changes.

The index also gives traders an additional investment vehicle if they’d like to open a position on the market as a whole as opposed to individual cryptocurrencies.

Product Development

In December, Alphacat’s ACAT store listed eleven new applications, bringing its total number of apps to 65.

The apps are distributed in the following categories:

- Market Forecasting: 11 Apps

- ACE Indices: 1 App

- Technical Analysis: 6 Apps

- Multi Data: 17 Apps

- Risk Management: 1 App

- Asset Allocation: 2 Apps

- Trading Tools: 19 Apps

- Derivatives Market: 7 Apps

- Others: 1 App

The applications have been developed by Alphacat as well as third-party teams.

Some progress was also made on Alphacat’s real-time forecasting engine to predict the price of cryptocurrencies. The engine reportedly went through an algorithm change that reflected a 5% increase in its prediction accuracy.

Alphacat will continue to refine its algorithm with additional transaction backtesting from historical data.

The full report can be found at the below link:

https://medium.com/@AlphacatGlobal/alphacat-report-december-16-31-da54b138b4b6

About The Author: Matthew North

Matthew North is a freelance writer and journalist who resides in East Asia. He spends his time writing and learning about financial technologies like the Blockchain and digital currencies. You can follow him on twitter @fintech_matthew.

More posts by Matthew North