O3 Labs has released a litepaper for O3 Swap, its cross-chain liquidity aggregation protocol. O3 Swap is designed to provide users with the most cost-effective rates and a simple one-click transaction process for swapping assets between different blockchains or L2 networks.

The litepaper gives a more comprehensive overview of the protocol’s design, including how liquidity is sourced and incentivization is handled.

In a recent announcement, O3 Labs also reported securing US $2 million in funding from several notable funds. The listed investors are: GC Ventures, OKEx Blockdream Ventures, SevenX Ventures, FBG Ventures, Neo Eco Fund, BTC12 Capital, Incuba Alpha Labs, Moonwhale Ventures, and Puzzle Ventures.

Accompanying the funding announcement was a note that the O3 Swap service will soon enter a testing period. More information can be found in the roadmap.

Litepaper

The litepaper published by O3 Labs provides a more comprehensive view of the protocol’s design. Several key advantages for users are touted:

- Permissionless – Open to anyone to use without KYC.

- Liquidity aggregation – Sources the best exchange rates and most efficient trading routes from different non-custodial exchanges.

- Cross-chain exchange – Implements proven cross-chain solutions to provide users with one-click trades between assets on different blockchains.

- Community-driven – Generates a governance token which will be used to decentralized control over platform development in addition to other utilities.

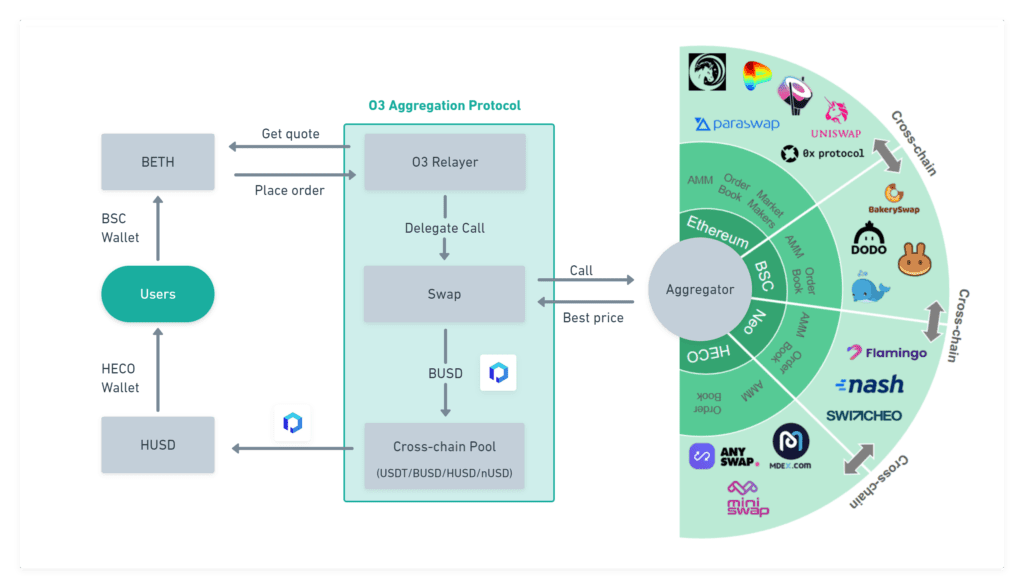

From the perspective of an O3 Swap user, a transaction between any two assets can be triggered with a single click. In the background, the aggregation protocol will calculate the best rates across decentralized exchanges for the given assets. Swaps between assets are processed using the most competitive rates from decentralized exchanges or directly through O3 Swap’s own cross-chain pool.

A complete API service will also be provided to give application developers an easy way to integrate O3 Swap into their own platforms.

System design

At the center of the service is the O3 Hub, a cross-chain asset pool. Based on Poly Network to support assets from any participating blockchain network, the Hub allows users to provide liquidity using one or more assets or swap between them directly. This design is intended to let users exchange cross-chain assets without the usual deposit/withdrawal processes, reducing the number of operations.

The O3 Hub will also provide a separate stablecoin pool, based on the StableSwap invariant by Curve to ensure low price slippage and minimal impermanent loss.

O3 Aggregators are the other key component, deployed to different blockchains or L2 networks to help users find the best trading rates or routes in the corresponding network. The aggregation protocol involves relayer contracts, deployed to each chain to find the best exchange rates for different asset pairs. Relayers send exchange requests from users to the O3 Swap mechanism, which then achieves liquidity settlement using smart contracts.

An Aggregator will interface with different non-custodial exchanges native to its network, including AMMs and order book-based systems.

Governance and Economics

Fees and other token reserves are managed in a Treasury, under the control of a Development Committee. This role is initially operated by O3 Labs, but in the future community contributors and voted representatives will also join the committee. Eventually, full decentralization of the committee is intended.

Protocol incentivization is handled using the O3 token. It is generated or acquired through a range of different actions, including participating in governance, liquidity provision, and trading. These tokens are initially obtained in a locked state—to actually retrieve the tokens, users must provide liquidity to O3 trading pairs in supported DEXs.

Unlocking tokens in this way allows them to be staked for interest, and qualifies the users for transaction discounts determined by the treasury. Unlocked tokens can also be staked to initiate proposals and participate in governance votes, or used to provide further liquidity for additional yields.

Most O3 Swap platform revenue is used to buyback O3 tokens on open markets, where it is sent to the Treasury for redistribution to O3 stakers. Trading fees from the cross-chain swap mechanism itself are distributed to the pool’s liquidity providers, increasing the amount of underlying token that each LP token can be redeemed for.

Token allocation

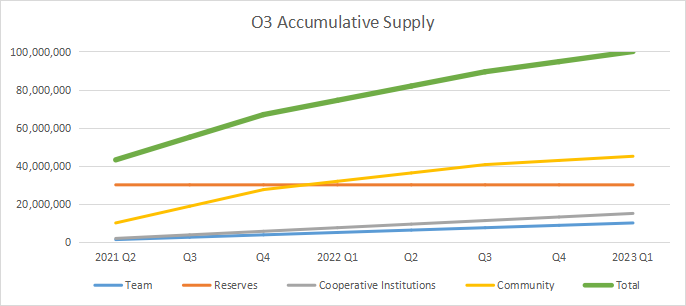

The issuance limit for the O3 token is 100,000,000, which is distributed in two phases. Ten percent will be issued in the first phase—half as an incentive for the early contributors, and half as locked rewards for early users and other community supporters.

Distribution in the second phase is divided as follows:

- 35% as trade mining incentive for traders and liquidity providers, with decremental vesting over two years

- 10% as an incentive for the O3 Labs team with linear vesting over two years

- 15% for investment & cooperating institutions with linear vesting over two years

- 30% held in reserve for future project development

Under this model, all O3 tokens would be generated by approximately Q1 2023.

About The Author: Brett Rhodes

Brett is a blockchain enthusiast and freelance writer who originally began producing content for the gaming & eSports industries. Now he spends most of his time contributing in the Neo ecosystem.

More posts by Brett Rhodes