The O3 Swap module has entered beta testing, offering a platform for one-click trades between assets on different blockchains. In a recent AMA hosted by Flamingo, O3 Swap design lead, Tim, discussed the unique characteristics of the Swap platform, integrating with Flamingo, next steps, and more.

Announced in April 2021, O3 Swap is designed to provide users with the most cost-effective rates for swapping assets between different blockchains or layer two networks. On O3’s proprietary trading protocol, Tim said:

[O3 Swap] aims to resolve the problem of liquidity fragmentation in blockchain networks… We are committed to providing a one-stop aggregation and exchange platform for users, and offering developers access to an open, distributed, friendly, and secure trading environment.

The swapping platform is currently in beta testing and available to all users. During the testing phase, token swapping is capped at an equivalent value of US $20.

The O3 Swap beta supports Neo, Ethereum, Binance Smart Chain, Huobi ECO Chain, and cross-chain stablecoins (i.e., USDT, BUSD, HUSD).

Eventually, O3 Swap aims to host liquidity pools, but the team hasn’t determined which trading pairs will be on the platform. Although according to Tim, “[they] will probably be the main assets on Flamingo.”

Looking forward, O3 Labs aims to launch the O3 token and release an overview of the token economic model in May 2021. The O3 token will be generated or acquired through various different actions, including participating in governance, liquidity provision, and trading. Afterward, the team will introduce transaction mining and other incentive-based community initiatives.

A full transcript of the AMA can be found below:

Adam: I think the Flamingo community already familiar with O3 Labs, a long time ecosystem partner. Tim is here to introduce another product O3 Labs is currently working on. Hi Time, can you please introduce yourself?.

Tim: Hi Adam, thanks for having me today.

I am Tim from O3 Labs. I am in charge of the O3 Swap design, alongside all our outstanding teammates. Before joining the O3 Labs, I was a project manager in a consultant company based in Hong Kong.

Glad to e-meet you guys here and share our new product with you.

Adam: What in O3 Swap? What problems does it solve? How does it relate to O3 Labs?

Tim: O3 Swap is a cross-chain aggregation protocol built by O3 Labs. It aims to resolve the problem of liquidity fragmentation in blockchain networks.

O3 Swap v1 will allow users to trade safely and simply across chains within the decentralized wallets. We are committed to providing a one-stop aggregation and exchange platform for users, and offering developers access to an open, distributed, friendly, and secure trading environment.

Adam: As a cross-chain aggregation protocol, how does O3 Swap differ from the other aggregators on the market? What advantages do you see in O3 Swap?

Tim: As I understand, most of the cross-chain technology in the current market belong to two categories, one is a bridge, the other is a hub; bridge mainly realizes asset packaging/transfer to another network, the limitation of Hub lies in all of the assets need to be deposited and converted into a specific hub network and then allow users to accept the hub network assets.

The O3 team has worked hard on innovative explorations of cross-chain transactions. It is the first to use the method of the cross-chain pool to connect different liquidity of assets on the chain, allowing users to exchange cross-chain assets without asset deposit and withdrawal, which greatly reduces the threshold for user operations/transactions.

Adam: How will O3 Swap integrate cross-chain liquidity pools? What’s the mechanism behind the cross-chain asset exchange?

Tim: Let me share a photo first.

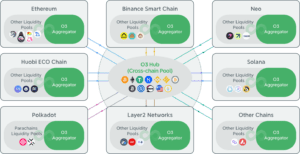

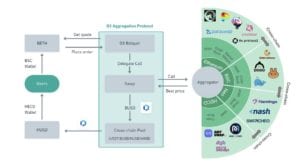

The main functional modules of O3 Swap include the exchange aggregators (O3 Aggregator) and cross-chain pool (O3 Hub).

O3 Aggregators are deployed on mainstream blockchains and help users find the most effective trading rates and routes in the corresponding network.

O3 Hub provides users with cross-chain transaction services based on Poly Network and supports users to add liquidity by a single token from different chains to earn O3 rewards.

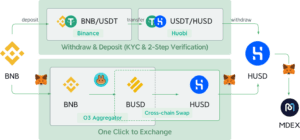

We take BNB to HUSD, for example: in the centralized route, traders need to deposit the coin to the centralized exchange and execute the transaction twice with KYC & 2-step verification, finally withdraw it to the decentralized wallet and DEX.

In the O3 decentralized route, we provide the one-step trading experience via our aggregators and cross-chain pool, allowing traders to exchange multi-chain assets within their wallets. The whole process is no account limit and permissionless.

Adam: How can Flamingo users participate in O3 Swap, and what are the interactions between Flamingo and O3 Swap? On a macro level, how can O3 Swap help to expand Flamingo’s ecosystem?

Tim: O3 Swap can aggregate liquidity sources from leading DEXs across different chains, including Flamingo. By aggregating Flamingo’s liquidity, traders are able to access the Flamingo AMM pool simply in O3 Swap.

On the other hand, users can also add LP on Flamingo to earn FLM and stake them on O3 Swap to earn O3 tokens. In the long term, I think this will benefit both the O3 and Flamingo ecosystems.

Adam: What are the specific application scenarios for the O3 token, and how does the system work for value capturing?

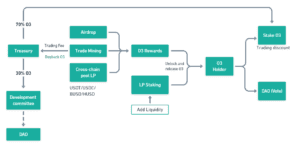

Tim: This is our token economics model.

There are three primary implementations of O3:

- Member rights: Stake O3 to obtain interest and transaction discounts allocated by the O3 Swap treasury.

- Community governance: Users can participate in community governance by staking O3 to initiate proposals, participate in voting, etc.

- LP staking: Users can use O3 to synthesize liquidity equity proof (LP), which can be used for unlocking and mining. On the other hand, all transaction fees from O3 Swap will regularly be used to buy back O3 in open markets and distributed to O3 stakers and development committees in proportion.

Adam: How can users obtain the O3 token?

Tim: The O3 token can be acquired in the following three ways

- Get Airdrop through early participation in product testing and community activity.

- As trade mining rewards for using O3 Swap.

- By providing liquidity to cross-chain pools.

The good news is that currently, we have a public testing event. Check our Twitter for more information.

Adam: There aren’t many wallets developing swapping platforms in the market. Do you see that as a problem or a trend?

Tim: DeFi innovation has brought many practical applications to the industry and has truly promoted the development of open finance. We believe this is one of the most important directions of blockchain technology.

Wallets carry users’ trust in security and are the best entry point for connecting DeFi applications. For the DeFi project side, the wallet is the entrance for users and credit endorsement. For the user side, the wallet can optimize the operating experience and lower the barriers to participation.

So, I think wallet and swap will continue to develop.

Adam: How is the development progress going on? What are some of the plans you could share with us?

Tim: At present, our official website is online and supports the cross-chain exchange of assets on Neo, Ethereum, BSC, and Huobi ECO Chain for the public test.

Our litepaper v1 is also online. More detailed product information can be found at the following link:

https://o3swap.com/

In the next step, the O3 token and economic model will be released in May. Transaction mining and other community incentives will be initiated soon.

In Q4 this year, we plan to complete the deployment of the layer two network. For the latest product update information, follow our Twitter and join our community.

Q1: What sorts of liquidity pools will appear on O3 Swap? FLM-O3, ETH-03, BTC-O3?

Tim: We haven’t decided which trading pairs to support. But, they will probably be the main assets on Flamingo. This way, you will earn FLM and also O3 by staking them on O3 Swap.

Q2: Are there any plans to develop a stablecoin liquidity pool for cross-chain?

Tim: The cross-chain pool is one of our innovations. The cross-chain asset pools include stablecoin pools and cross-chain protocol based on Poly Network. We now support USDT, BUSD, HUSD, and have been providing liquidity to the pool.

Q3: Can you explain how the O3 Swap aggregator works and how it decides the best route for the O3 user?

Tim: You can see this picture, we set different aggregators across chains and compare the trading price from different DEX.

Q4: Are you planning a marketing campaign to push the project? How do you think 03 will benefit from it?

Tim: yes, we are planning to organize many campaigns and activities soon. For now, we have two events ongoing

- https://twitter.com/O3_Labs/status/1381233292599459842

- https://twitter.com/O3_Labs/status/1384498301538500613

Note: Some edits have been made for formatting and readability.

About The Author: Dylan Grabowski

Dylan is a reformed urban planner with a passion for covering the Neo ecosystem. His objective as a writer for Neo News Today is to report news in an objective, fact-based, non-sensational manner. When not behind a computer screen, he can be found in the mountains rock climbing. Find Dylan on Twitter (@GrabowskiDylan).

More posts by Dylan Grabowski