The Flamingo Finance protocol is launching this week, beginning with Flamincome, an Ethereum-based yield booster, on September 23rd. It will be followed by a five-day Mint Rush period for participants to earn NEP-5 FLM tokens, beginning on September 25th.

To discuss the launch, Neo founder, Da Hongfei, and Neo Global Development (NGD) Ecosystem Growth director, John Wang, joined two separate ask me anything (AMA) events. Da participated via the official Flamingo Finance Discord channel on Monday, September 21st. And Wang joined the Free Coins 24 Community official Telegram channel on Sunday, September 20th.

In both of the AMA’s, Wang and Da discussed the Flamingo Finance DeFi protocol in the context of broader industry trends, NGD and the Neo Foundation’s (NF) role in Flamingo, the Ethereum-based Flamincome yield aggregator, and details about the upcoming FLM Mint Rush.

The below is a summary of answers provided to the communities across both AMAs.

Flamingo and DeFi in the broader blockchain industry

What is Flamingo?

John Wang (NGD Ecosystem Growth director): Flamingo is an interoperable, full-stack decentralized finance protocol built on the Neo blockchain.

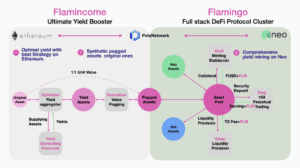

Flamingo is comprised of five main components, including a cross-chain asset gateway (Wrapper), an on-chain liquidity provider (Swap), a one-stop asset manager (Vault), an AMM-based perpetual contract trading platform (Perp), and also a decentralized governance mechanism (DAO).

FLM is the governance token of Flamingo and will be 100% distributed to the community based on participation.

How do you position Flamingo in Neo’s ecosystem and Flamingo’s significance in the blockchain industry?

Da Hongfei (Neo founder): Flamingo is the enabling module of Neo’s DeFi ecosystem. We can see that Swaps are the most core module in the recent rise of DeFi. This is a critical marketplace to connect all kinds of assets.

Through NGD’s incubation, we are quickly implementing our own Swap based on Neo smart contracts, rather than a simple imitation of Ethereum-based Swaps. In addition to Swap, Flamingo will also provide a collateralized synthetic stablecoin – FUSD, similar to Synthetix (sUSD) and MakerDAO (DAI). Once FUSD is live, it’ll be used for 10x margin trading of AMM-based perpetual contracts.

We hope more developers will use the basic modules of Flamingo to develop more applications. From a macro point of view, if Flamingo is proven successful, we will bring some insights about originality to the public blockchain space. Instead of the current situation where teams are rushing to Ethereum to build liquidity pools cascaded by liquidity pools.

Why do you think Flamingo will stand out in the current DeFi craze?

Hongfei: First is high capital utilization. For example, a liquidity provider’s proof in Swap, LP Token, can be used to mint FUSD, and FUSD can be used to trade 10x perpetual contracts. This is an excellent advantage of the Flamingo full-stack model. The liquidity of each module can be reused to the maximum extent.

Second, fair launch and equal opportunities. Flamingo does not have any pre-sale, team reservation, or pre-mining; everyone participates on a leveled ground.

Third, asset diversity. During Mint Rush and the NEO pool, which will have 50% of the FLM distribution, another 50% of FLM will be obtained by staking cross-chain assets. This includes wBTC, ETH, USDT, Uniswap V2 wBTC/ETH LP, ONT, and a few other assets (that will be announced later). Moreover, most of the ERC-20 assets can continue to generate yields on Ethereum, as well as farming on Neo.

Fourth, we will also launch the DAO governance module as soon as possible to allow the community of FLM holders to steer Flamingo’s direction.

The three features of Flamingo are interoperable DeFi, radical equality, and capital efficiency. What makes Flamingo features “unique” compared to other platforms?

John: Thank you for doing some research on Neo and Flamingo Finance. These indeed are our three essential features. Capital Efficiency is unique already – it’s double many other projects because users can also earn the FLM token. For instance, using Flamincome, you can stake Uniswap Liquidity Provider tokens and earn from Uniswap and Neo at the same time.

Additionally, Neo’s unique feature is that transactions are very cheap (and sometimes even free). Therefore, claiming and sending FLM will be very affordable and, in some cases, free. This resolves quite a massive pain point of the current Ethereum network.

Many chaotic situations have accompanied the upsurge of DeFi, so the smart contract’s security is an issue of great concern. How is Flamingo guaranteed in terms of security?

Hongfei: First of all, to do yield farming, or liquidity mining, although it does not cost money, you have to stake your assets into the smart contract, so there are opportunity cost and safety concerns.

The security of contracts and wallet is our priority. All contracts are audited before going live. The NeoLine wallet is also undergoing significant tests.

PeckShield does the audits of Flamingo and Flamincome, and the audit reports will be released soon. Further, mature farming strategies from yEarn are re-used to ensure safety.

NGD and NF role in Flamingo

As an established public chain, what are the considerations behind Neo’s decision to incubate the Flamingo project?

Da Hongfei: I would say there are several considerations. First of all, many team members, the community, and I are all optimistic about the future of DeFi – we genuinely believe that it’s going to change the existing financial paradigm.

As a digital asset protocol, Neo has a relatively mature smart contract system, a large asset base, and an active community across the world, which makes Neo a good platform for DeFi.

In the past, NF and NGD were not directly involved in incubating projects. Still, they helped community projects in funding and tech. This time, NGD participated in the incubation process because some basic modules are necessary for the development of DeFi, and we have to compete against time.

Neo3 will launch around January 2021. We need to understand the application layer’s requirements to do an excellent job in the protocol layer.

We did discover some areas to improve at layer one and have made such necessary changes.

At the same time, I also hope to activate the global Neo community through this opportunity and explore our future directions together.

As a project incubated by NGD, Flamingo has to become a project governed by DAO. So how will the NF and NGD participate in Flamingo?

Hongfei: To ensure the security and a better user experience, we decided to postpone the launch of Flamincome on Ethereum for two days.

So, Flamincome and Flamingo Wrapper will launch together on the 23rd, followed by two days for users to do cross-chain assets wrapping/minting. The Mint Rush will still start on the 25th, together with the launch of Vault. FLM will begin to generate on the 25th. The 23rd is more like preparation, 25th is the starting date.

During Mint Rush, you only need to stake your assets for a total of five days, and there is no impermanent loss.

Only by providing liquidity to Swap, you may bare impermanent loss.

How will NGD and NF participate?

Hongfei: NF/NGD will participate in three ways. First, to get FLM and later provide liquidity for NEO and FLM pairs for the Swap to be launched on September 30th.

Second, to use the FLM to participate in governance. Though, we aim to make Flamingo governed by a DAO as soon as possible.

Third, to use the FLM for the future operation and incentive NF/NGD will ensure non-NF/NGD participation takes up most of the NEO pool.

Flamincome

What is Flamincome?

John: If you’ve used Uniswap before, you know that for providing liquidity there, you received so-called Liquidity Tokens, according to the pairs that you provide.

One of the most popular pairs is wBTC/ETH, and we will accept LP tokens of that pair! Where Uniswap provides UNI token rewards for those trading pairs, Flamincome will provide FLM rewards.

And, FLM is not only a governance token. It will list on significant exchanges, so stay tuned for more information.

As an essential module of Flamingo, many community members are interested in Flamincome, but many are still confused about it. Can you explain to us how it works?

Hongfei: Flamincome is built on Ethereum, and we call it the “Ultimate Yield Booster.” It is similar to yEarn but does cross-chain farming as an enhancement.

Let me give you an example to illustrate it better: Alice deposits USDT (imagine it as deposited money) into Flamincome and gets a fUSDT token (the certificate of deposit), which can then be staked and normalized into a new token called nUSDT, which pegs to the original asset USDT (a loan against the certificate of deposit). The newly minted nUSDT can then be transferred to Neo blockchain to participate in farming in Flamingo. USDT and nUSDT are mining for you at the same time at two blockchains, which is the magic of Flamincome.

The specific process is shown in the figure above. It’s quite complicated, which is why I said don’t expect the user experience to be good. But money never sleeps. I think the more important thing is how to improve the utilization rate of capital.

How does Neo aim to attract investors from the current DeFi options and solutions, such as Maker DAO and Synthetix, and disrupt these Ethereum-based DeFi projects?

John: The current DeFi landscape is amazing: it’s rich and yet evolving fast. This means it presents new opportunities for new platforms to roll out products and services, offering something that wasn’t on the market before.

Flamingo Finance consists of several products, and Flamincome is one of them. Using Flamincome, you can stake Uniswap wBTC/ETH LP (liquidity provider) tokens, meaning participants can earn from providing liquidity on Uniswap (i.e., UNI tokens) and earn Neo’s FLM at the same time.

This is a unique feature that will attract new users from other projects, even though the market is large enough for all users of these projects.

Earning FLM

Flamingo is defined as a project that allocates all incentives based on contribution. Can you explain this a little further?

Hongfei: This involves the highlight of radical equality I mentioned earlier. There are several types of actions that can be defined as contributions in Flamingo. First, minting/staking assets, including native (i.e., NEO) and cross-chain assets ( i.e., BTC, ETH).

Second, providing liquidity into asset pools such as Swap’s FLM/NEO pair.

Third, minting FUSD stablecoin by staking assets to Vault and using that as collateral to mint FUSD.

Fourth, trading perpetual contracts and providing liquidity for Flamingo Perp.

Lastly, using FLM to govern Flamingo via DAO.

The FLM token will be distributed to users who perform all of these actions.

What about other tokens? Which NEP-5 tokens will be allowed?

Hongfei: Participants can use Uni ETH/BTC LP to join the FLM Mint Rush.

GAS will not be used for FLM minting. The market cap of GAS is too small. You can’t use it to stake; otherwise, it will drive the price too high, and too expensive to do transactions. Regarding NEP-5 tokens, it is the same situation. Their market caps are too small to be used.

All the tokens that Flamingo use will likely have a market capitalization of over US $100 million.

The additional 17.5% other tokens that can be used for the FLM Mint Rush will be announced soon.

What wallets will be available for use for FLM minting?

Hongfei: The NeoLine chrome extension (for PC) will work, and probably O3 desktop.

I’m not sure if the O3 Wallet and Ledger will be ready on the 25th. The team will need to check that out in the coming days. I not sure whether Ledger can be used or not. The devs are not testing with Ledger, only NeoLine.

To mint cross-chain assets, users will need to use Metamask and NeoLine.

Note: Some edits have been made for formatting and readability.

About The Author: Dylan Grabowski

Dylan is a reformed urban planner with a passion for covering the Neo ecosystem. His objective as a writer for Neo News Today is to report news in an objective, fact-based, non-sensational manner. When not behind a computer screen, he can be found in the mountains rock climbing. Find Dylan on Twitter (@GrabowskiDylan).

More posts by Dylan Grabowski