Intersect Finance has launched its borrowing-and-lending platform on the Neo X EVM sidechain TestNet. To incentivize activity, Intersect is currently running a points reward campaign to stress-test the protocol, offering users a share from a pool of 1 million points.

Intersect Finance is the first lending protocol to launch on Neo X. It aims to power flash loans, high-efficiency borrowing, yield farming, and a tool for rewarding user engagement. Intersect was built by Switcheo Labs, a DeFi development studio with long-standing roots in the Neo ecosystem dating back to the first COZ dApps competition that concluded at Neo DevCon 1 in Jan. 2018.

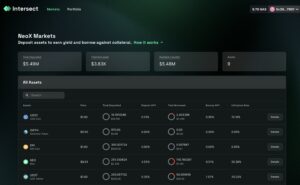

The platform currently allows users to deposit, withdraw, borrow, and repay a loan with the following TestNet assets: SWTH, NEO, WGAS10, USDC, SUDT, WBTC, WETH, WSTETH, and DAI. While the team is launching support for EVM-based assets on Neo X, Intersect ultimately aims to offer support for Neo N3 assets on its platform.

Borrow-and-Lend

Intersect users can supply collateral to the platform and earn interest. The rates are algorithmically adjusted based on the underlying asset’s supply and demand. Intersect doesn’t impose a minimum deposit amount; however, each supported asset has a supply cap to manage risk and ensure protocol stability. The cap is determined by market conditions and the asset’s general liquidity.

When an asset is deposited, the user receives an aToken (i.e., aUSDC for USDC), representing their supplied balance. When the user returns the aToken, they’ll receive the initial deposit and interest accrued while the asset was lent on Intersect.

When borrowing an asset, the user faces the potential of liquidation, which is a risk management process that helps protect the protocol’s solvency and lenders. The Health Factor icon represents the user’s risk of potential liquidation – the higher the health factor, the less at risk the user’s loan. To protect a position from liquidation, the borrower can monitor their health factor, add collateral, repay the debt, use risk management tools, and be aware of market volatility.

The borrow-and-lend features closely resemble those users can find on other platforms, but Intersect will offer two unique features on its protocol.

Flash Loans and Efficiency Mode

According to Intersect, Flash Loans are a revolutionary concept in the broader DeFi ecosystem. Users can borrow digital assets from the platform without providing any underlying collateral. The caveat is that the loan is only available for a very brief period of time, typically within the same block that a transaction occurs, which is approximately 10.9 seconds on Neo X at the time of press.

The borrower must build a smart contract to request a flash loan, which includes how the loan will work with payback steps, interest, and fees. The user borrows assets from a lending pool, performs a series of actions or trades, and then returns the borrowed assets (plus the additional fees) to the lending pool. If the loan is repaid successfully, the transaction is confirmed and added to the blockchain. If not, the transaction is reverted, and nothing will happen.

Intersect’s Efficiency Mode (or E-Mode) feature is designed to maximize capital efficiency for users when dealing with assets that have correlated prices. E-Mode allows users to put forth lower amounts of collateral to take out loans on particular assets with higher loan-to-value ratios. For example, stablecoins are pegged to the US dollar, offering higher LTV ratios when USDC is used as collateral to borrow USDT.

While E-Mode offers higher leverage opportunities, the ability to borrow other assets is restricted to those within the category (i.e., stablecoins, ETH-correlated assets).

The Intersect team has launched a points program to encourage users to test the new borrow-and-lend protocol being built on Neo X.

Intersect Points Program

The Intersect Points program was designed to reward active participants within the platform’s ecosystem. By engaging with various facets of Intersect, users can earn points that unlock benefits within the dApp. Examples of benefits include the ability to participate in governance processes, access to exclusive features and products, potential token airdrops, tier-based benefits and rewards, and community recognition via leaderboards.

Users can earn points for performing various activities, such as:

- Supply: 100 IP

- Borrow: 200 IP

- Repay: 100 IP

- Withdraw: 100 IP

- Liquidation: 500 IP

- Referral:15% of a referred user’s earned IP

Intersect Points will be calculated hourly and will only count the first time a user executes an action. Points earned on the TestNet platform will transfer to MainNet once it’s live.

The full announcement can be found at the link below:

https://medium.com/neo-smart-economy/welcome-intersect-the-first-lending-protocol-on-neo-x-716cb78cb11c

About The Author: Dylan Grabowski

Dylan is a reformed urban planner with a passion for covering the Neo ecosystem. His objective as a writer for Neo News Today is to report news in an objective, fact-based, non-sensational manner. When not behind a computer screen, he can be found in the mountains rock climbing. Find Dylan on Twitter (@GrabowskiDylan).

More posts by Dylan Grabowski