FutureDAO, a Chinese project that aims to create an efficient and responsible “next generation of financing” for equity crowdfunding, has released a whitepaper and website outlining its design and vision. FutureDAO is a project from NewEconoLabs founder Bruce Liu and the NewEconoLabs development group.

What is a DAO?

The decentralized autonomous organization, or DAO, is an organizational structure that has been made more possible to realize with the advent of programmable blockchains such as Ethereum and NEO. Although details of each autonomous project differ, most DAOs have some common traits:

- The projects are controlled by the tokenholders of their cryptocurrency token;

- The project’s rules of governance are enforced by computer code deployed on a programmable blockchain.

Autonomous organizations gained a share of infamy in the summer of 2016, when an Ethereum ICO known as “The DAO” collected $50 million in a crowdsale, making it the largest ever ICO at the time. The project’s smart contract was hacked soon after, and hackers made off with 3.6 million ETH tokens (over 3% of Ethereum’s total supply). This led to a crisis in the Ethereum community, which voted to hard-fork Ethereum in order to return the hacked funds to the project’s investors. Those in the Ethereum community who objected to the bailout continue to use the original Ethereum chain, which is now rebranded as Ethereum Classic, to this day.

Development of the DAO and DAICO

The concept of a decentralized autonomous group was first described by Daniel Larimer in September 2013, and his first major cryptocurrency project, Bitshares, is organized as a DAO. Larimer’s concept was of a self-operating cryptocurrency with a highly decentralized structure, “where the source code defines the bylaws,” that sought to “earn a profit for its shareholders by performing valuable services.”

In January 2018, Ethereum founder Vitalik Buterin proposed an advancement on the concept. Buterin’s decentralized autonomous initial coin offering (DAICO) was highly focused on protecting ICO investors by giving them control over the rate at which projects receive their funding. Token holders are also offered the option to terminate a project by liquidating its ICO treasury, to be split equally amongst token holders.

FutureDAO and the DAICO

FutureDAO brings further developments to the DAICO model, many of which are focused on reducing costs and providing even the smallest projects with a guaranteed market. Traditional ICOs offer a one-time crowdsale with a fixed supply of tokens, the DAICO proposed by FutureDAO functions differently.

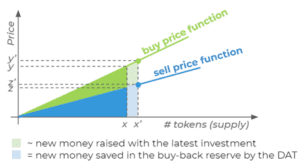

In the FutureDAO token model, the crowdsale never ends. In this continuous fundraising model, there is no cap on the total number of project tokens that can exist. Secondary markets on exchanges are optional, because the smart contract will always offer to mint more project tokens for a price, and will always offer to buy back project tokens to be burned. The buy and sell prices that are offered by the contract will increase automatically if more tokens are purchased (minted), and will decrease automatically if tokens are sold back (burned).

As in Vitalik’s DAICO proposal, the FutureDAO smart contract will fund the project’s developers at a rate controlled by its tokenholders. Tokenholders are also given the option to cancel project funding and refund investors with a vote. The FutureDAO model differs from Vitalik’s original ICO proposal by maintaining funds in reserve to buy and burn the project’s entire token supply.

In the FutureDAO model, the smart contract’s token minting price is always higher than its token burning price. This token model is known as the “dual bonding curve” model. The spread, or difference between the minting and burning prices, is the source of the project’s funding. As previously mentioned, these funds are slowly made available to the project through a faucet, or “tap”, controlled by the tokenholders.

Blockchain-based governance for FutureDAO projects is planned to exist of a simple majority vote for proposed actions, with a 30 percent “NO” vote sufficient to veto a proposal. Additionally, incomplete refunds can be issued, with a significant minority of investors opting to exit while others choose to continue on with the project.

Ethereum and NEO

In the FutureDAO community group, founder Bruce Liu outlined his focus on cultural projects with tight-knit communities and real cash flow, stating that “we hope that the projects financed through the FutureDAO platform will have profit expectations and have the characteristics of community. We think that games and animation are very suitable project types.”

Liu also announced that FutureDAO will build on “multiple chains” including both Ethereum and NEO. Projects will be able to select a blockchain to operate on, and fiat-pegged stablecoins like USDT are seen as the best medium with which to fund projects. In further communication with NEL team members, FutureDAO’s revenue model was outlined as “similar to listing fee with exchanges;” the team reiterated Liu’s avoidance of speculation and focus on helping “projects who can produce real cash flow raise funds.”

About The Author: Colin Closser

Colin Closser, M.D., was a speaker at the first NEO DevCon in San Francisco. A devoted contrarian, he has managed the improbable: a peaceful and healthy life, despite holding a medical degree. He aspires towards the wisdom of Michael Lewis and Nassim Nicholas Taleb.

More posts by Colin Closser