Lyrebird won the Best DeFi project award in the Neo Frontier Launchpad with its algorithmic stablecoin and synthetic coin protocol. Lyrebird is aimed at being the first stablecoin on the Neo N3 blockchain.

Longer-term intentions include becoming a community-owned synthetic asset platform that can mint fungible tokens pegged to the values of world currencies, securities, crypto assets, and other commodities with a well-defined price. The protocol relies on arbitrageurs to stabilize price of its stablecoin.

The Importance of Stablecoins

Stablecoins are often designed to maintain a peg to US $1. This means that regardless of price volatility in cryptocurrency markets, the stablecoin will hold a steady value relative to the dollar. By reducing this volatility, the stablecoin can act as a foundational building block for finance-based dApps, allowing businesses to leverage the inherent benefits provided by cryptocurrency, such as borderless payments, 24/7 access, and full custody, while mitigating the risk of price fluctuations.

In Q1 2021, stablecoins as a broad asset class had $869 billion in transaction volume, higher than either Bitcoin or Ethereum’s individual transaction volumes. At the time of press, approximately $79 billion in stablecoin value is circulating across various blockchain networks.

In the summer of 2020, Da Hongfei identified a reliable stablecoin as one of Neo’s “missing pieces.”

As of Aug. 2021, the Neo ecosystem has one stablecoin, USDT, stored in Flamingo Finance contracts. Currently, there is approximately $16.8 million fUSDT on the Flamingo platform. However, the fUSDT must be wrapped from tokens on other blockchain networks, meaning this stablecoin is not native to Neo.

Lyrebird founder and developer William Song believes that a Neo-native stablecoin would strengthen the ecosystem. Song, a developer located in New York, US, builds trading systems for a financial services company, an industry where the stakes of risk are very high. He noted, “I think if we have a dependency on the Ethereum ecosystem and Tether, that actually exposes us to a lot more risk than we expect.”

Lyrebird’s Algorithmic Model

Unlike traditional stablecoins, Lyrebird’s stablecoin, LUSD, isn’t backed by specific collateral. Instead, its peg to the US dollar is maintained by monitoring supply and demand and taking advantage of asset price discrepancies. This is known as arbitrage.

Song was inspired by the Terra ecosystem’s stablecoin, TerraUSD, when building the Lyrebird protocol.

There were specific things about the way that the Terra ecosystem, and specifically the interaction between TerraUSD (UST) and LUNA, that made it seem much more robust.” Song continued, “I think it does make sense to also have a USD-backed or other stablecoin, but I don’t really have the power to do that. So, I was focusing on something that I could do.

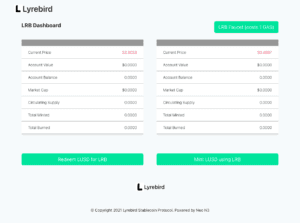

In general, algorithmic stablecoins work by balancing the supply and demand of the stablecoin and underlying asset. In Lyrebird’s case, LUSD is the stablecoin, and the LRB token is the underlying asset.

Lyrebird users can use LRB tokens to mint LUSD tokens. The amount of LUSD a user can mint depends on the current price of LRB and LUSD’s $1 peg. For example, if LRB was valued at $10, the user could use 2 LRB to mint 20 LUSD tokens.

Every time a user mints more LUSD, more stablecoins are entered into the circulating supply.

Conversely, users are able to burn LUSD tokens back into LRB. Like before, the amount of tokens the user will receive is dependent on the current LRB price and LUSD’s $1 peg. If LRB is valued at $5, a user could burn 5 LUSD in return for 1 LRB token.

Like the Terra protocol it was modeled on, Lyrebird works by balancing supply and demand. If demand for LUSD increases, the price will naturally increase, unless it is offset by an increase in the stablecoin’s issued supply. Demand could rise from adoption of LUSD in applications, usage as a quote currency against other tokens on exchanges, or other ways that require more users needing to own the token. The protocol relies on arbitrageurs to stabilize the prices of its stablecoins.

For example, if an LRB token holder notices demand rise for LUSD, such that it begins to increase in value above it’s US $1 peg, it will be profitable for them to convert LRB into LUSD.

In this scenario, the price of LUSD may have reached $1.05, however the amount of LUSD they can mint is still based on the price of LRB against the $1 peg. So, theoretically, the LRB token holder could convert $100 worth of LRB to 100 LUSD tokens, currently valued at $105, realizing a 5% profit.

However, as LRB holders continue to mint LUSD, the introduction of more stablecoins into the circulating supply means that it will rise in quantity to meet demand, and the LUSD price will begin to fall again towards $1.

If the supply of LUSD begins to exceed demand, then its price will begin to fall below it’s $1 peg. In this scenario, LUSD token holders are incentivized to burn LUSD back into LRB. If LUSD is valued at $0.95, then a user could burn 100 LUSD tokens valued at $95 and receive $100 worth of LRB tokens, realizing a 5% profit.

This process will continue to drive the circulating supply of LUSD down, until it again balances with demand and returns to the $1 peg.

Lyrebird Protocol Needs Community Faith

For Lyrebird to succeed, Song believes the Neo ecosystem needs to trust that the protocol is working as intended. Without a unified belief in the ability for the arbitrage mechanism to function correctly, a downward spiral of selling LRB would make it impossible for LUSD to keep its peg to the USD. The theory is that this model will succeed if a community builds around it and a network effect develops. Song noted:

For something like Lyrebird, you don’t have specific collateral; you have a mechanism that kind of allows arbitrageurs to keep the prices the way it is. But a huge risk is that you have everyone losing faith in the protocol altogether.

To instill trust in the Lyrebird protocol, Song noted multiple ways to integrate the Neo community.

One potential approach includes airdropping a significant quantity of the LRB token to NEO or FLM holders. If a large portion of LRB is distributed to ecosystem participants, then they’ll feel a part of the community and want Lyrebird to succeed.

Another method might be requiring LRB holders to stake their tokens and then enforcing a time-restricted withdrawal period. LRB holders would benefit from the price of LRB rising but would be limited in their ability to panic sell during drastic downward market movements.

Song also believes there should be governance mechanisms baked into Lyrebird. With governance, users can determine the direction of the platform’s development and potential listing of other synthetic assets.

Lastly, Lyrebird will open-source the first bot, Arby, to the community to establish soundness in the project and the arbitrage model. The team will also run the open-source version for early stability and community confidence.

Additional Opportunities

Along with an algorithmically backed stablecoin, Lyrebird aims to support “synthetics.” Synthetics are crypto-based assets that mimic the value of real-world assets, such as shares in publicly traded companies.

In the Terra ecosystem, the Mirror Protocol has developed a system where mAssets “mirror” the prices of equities in the US stock market using an oracle to check prices every 30 seconds. To mint an mAsset, an issuer must lock up 150% or more of the current asset value in stablecoins or other mAssets as collateral. If the real-world value of the asset rises above the collateralization limit, it will be liquidated. The Mirror Protocol team states that the collateral is what guarantees the solvency of its system.

The team claims mAssets, “Give traders the price exposure to real assets while enabling fractional ownership, open access and censorship resistance as any other cryptocurrency.”

Song said, “What I have as a vision for Lyrebird is a more synthetic asset protocol. Ultimately, I want Lyrebird to be community-owned. To have some voting mechanism so that you can kind of vote on what kind of assets you’d like to see. Then have the development team be able to put that in.”

While Lyrebird has the potential to be Neo N3’s first stablecoin, its potential to establish a peg with other synthetic assets like currencies or equities also excites ecosystem leadership. In a conversation with Neo News Today, Neo Frontier Launchpad judge, John deVadoss, said:

The Lyrebird team demonstrated brilliance and deep domain expertise in building an innovative community-centric synthetic asset platform. The Lyrebird design is both innovative and pragmatic – customer-focused problem-solving at its best! Kudos!

As a major prize recipient of the Neo Frontier Hackathon, Song won US $12,000 in NEO. After being awarded a 1.3x multiplier from the Planathon phase, the final prize rose to $15,600. He will also receive incubation support through NGD’s Early Adoption Program.

To learn more about Lyrebird, visit the Devpost link below:

https://devpost.com/software/lyrebird-rudw1h

About The Author: Dylan Grabowski

Dylan is a reformed urban planner with a passion for covering the Neo ecosystem. His objective as a writer for Neo News Today is to report news in an objective, fact-based, non-sensational manner. When not behind a computer screen, he can be found in the mountains rock climbing. Find Dylan on Twitter (@GrabowskiDylan).

More posts by Dylan Grabowski