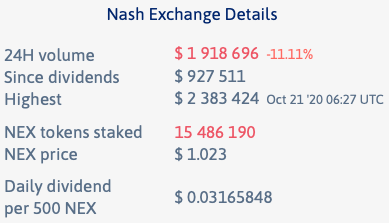

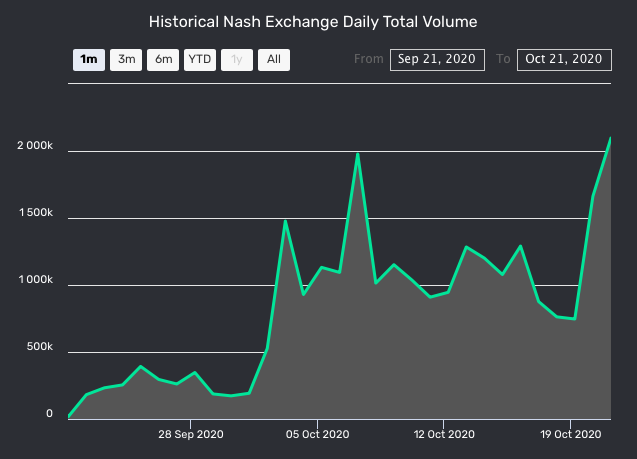

Nash recently surpassed US $2.3 million in 24-hour trading volume, achieving an all-time high for the non-custodial exchange. The high volume figures may be attributed to the beta liquidity mining program Nash launched on October 1st, 2020, which was designed to increase trading volume.

The program offers 100,000 NEX in rewards to participants who trade a $10,000 average volume per day each week, with at least of four days above US $10,000. Participants who meet the criteria share from a weekly reward pool of 20,000 NEX. The rewards pool is split between maker and taker volume at 10,000 NEX each.

On October 8th, Gunbot users became eligible to receive additional rewards as part of the program. Gunbot is an automated trading bot that executes trades across various exchanges on behalf of its subscribers. Gunbot is offering a pool of 100,000 GUNTHY tokens to those who use the Gunbot application to trade on the Nash non-custodial exchange.

25,000 GUNTHY are distributed each week, following the same eligibility rules as the NEX rewards.

So far, the liquidity program appears to have driven an increase in trading volumes on the Nash exchange over its first two weeks.

At the time of press, the exchange’s largest trading pairs are BTC/USDC and ETH/USDC. Nash has also noted it is removing the ANT/BTC market from its exchange.

The beta liquidity mining program will conclude in the first week of November 2020.

About The Author: Dylan Grabowski

Dylan is a reformed urban planner with a passion for covering the Neo ecosystem. His objective as a writer for Neo News Today is to report news in an objective, fact-based, non-sensational manner. When not behind a computer screen, he can be found in the mountains rock climbing. Find Dylan on Twitter (@GrabowskiDylan).

More posts by Dylan Grabowski