The Neo Foundation (NF) has released its financial report for the 2019 fiscal year, which includes NF’s expenditures and assets under management.

Accompanying the release was an address from the Neo Foundation thanking the community and its developers for their effort on the road to Neo3. The NF noted the progress made on key components such as NeoFS, NeoID, and the native oracle network, and highlighted a growing number of gaming and DeFi use cases in the Neo ecosystem.

Moving forward, the NF stated a commitment to maintaining the development pace achieved in 2019 and outlined key goals for 2020. These objectives include facilitating a smooth transition from Neo2 to Neo3 for ecosystem participants, the continued improvement of Neo’s developer experience, and the establishment of a governance mechanism to incentivize community participation and sustain the network.

Expenditures

NEO

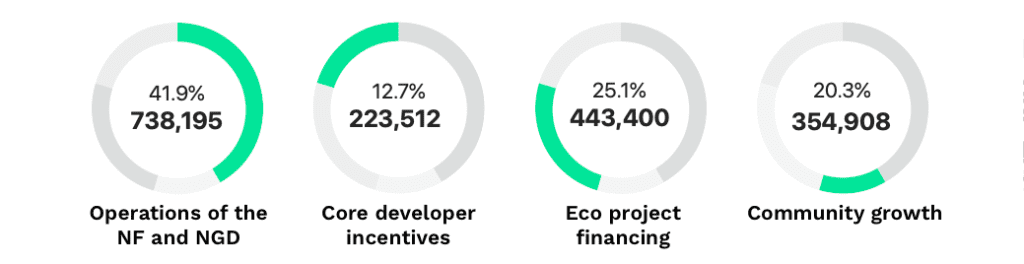

The Neo Foundation reported a total spend of 1,760,015 NEO in 2019 on various areas within the Neo ecosystem. A breakdown of disbursements can be found below.

Operations of the NF and NGD – (41.9%)

738,195 NEO were used for funding the operations of the NF and Neo Global Development (NGD). Examples of expenditures include salaries, marketing fees, rent, and other costs associated with running a business.

Core developer incentives – (12.7%)

223,512 NEO were distributed as core developer incentives for contributions dating from 2015 through to December 31st, 2019.

Ecosystem project financing – (25.1%)

443,400 NEO were invested in growing the ecosystem, which included projects like Nash, Liquefy, MixMarvel, and more. Additionally, 14,300 NEO was loaned to the Neo Eco Fund, managed by NGD.

Community growth – (20.3%)

354,908 NEO was used to finance the following Neo community groups: AlienWorks, COZ, NewEconoLabs (NEL), NEO-ONE, NeoResearch, neow3j, Neo News Today, Neo St. Petersburg Competence Center (Neo SPCC), and Red4Sec.

GAS

An additional 81,688.30 GAS was spent on financing the NF, NGD, and core developers. Over the course of 2019, 19,870.99 GAS was received through network fees, and 40,700 GAS was received through the exit of the GAEA project, totalling a net spend of 21,117.31 GAS.

Assets under management

Fund Investments

Before December 31st, 2017, the Neo Foundation (formerly known as the Neo Council) invested in several projects and exited with an equivalent of 1,060.29 BTC. Following that exit, 362.71 BTC was reinvested in NGC Fund I along with an additional 206,502 NEO. 697.58 BTC was reinvested in the Neo Eco Fund along with an additional 1,462,583 NEO and 233,991.59 GAS.

The report denominates the value of each fund in units of BTC.

NGC Fund I – 821 Units

NGC Fund I is managed by Neo Global Capital and is the for-profit investment branch of the NF. It invests in projects that do not directly compete with NEO. The financial report states that NGC Fund I paid 1 BTC for each dividend and the net value after dividend as of December 31st, 2019 was 2.77 BTC.

Neo Eco Fund – 3,746.55 Units

The Neo Eco Fund is managed by NGD and typically aims to invest in projects or teams that have “material synergies” with the Neo ecosystem. Neo Eco Fund’s unit value was reported to be 1.63 BTC as of December 31st, 2019.

The financial report notes major investment projects of NGC Fund I and Neo Eco Fund to include: Celer, CertiK, Cocos BCX, Coco Finance, Crypto FAST, Liquid, Liquify, MixMarvel, Moonlight, Nash, Ontology, Polkadot, Switcheo, Trinity, Tonart, Travala, and Zilliqa.

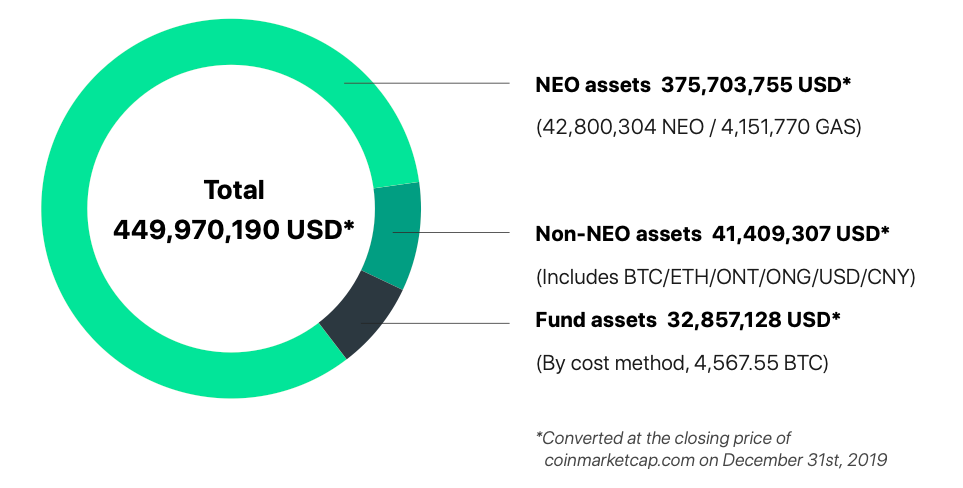

NEO & GAS

Following the spending of 1,760,015 NEO and 21,117.31 GAS in 2019, at total of 42,800,304 NEO and 4,151,770 GAS remains under the management of the Neo Foundation.

Non-NEO assets

The Neo Foundation assets portfolio also includes BTC, ETH, ONT, ONG, USD, and CNY, which had a reported worth of US $41,409,307 at the close of the financial year.

Total

Cumulatively, on December 31st, 2019, the NF’s total portfolio was valued at approximately US $449,970,190.

In closing the financial report, the NF notes:

The NF has always strived to make efficient use of all its assets to support the sustainable growth of Neo and its ecosystem. By the end of 2019, the NF was managing various types of assets. While NEO, GAS, BTC, ONT and ONG comprised the majority of assets, the NF also managed assets in terms of USD, CNY and funds. Current asset values ensure sufficient support for the sustainable growth of the NF, NGD, core developers, developer communities and the entire Neo ecosystem. Meanwhile, the diversified nature of managed assets will ensure a certain degree of robustness against black swans and market fluctuations for NF.

The 2019 year-end report is the second financial report released by the NF, which are intended to be released every six months. The first financial report was released in September 2019.

The announcement can be found at the link below:

https://neo.org/blog/details/4194

About The Author: Dylan Grabowski

Dylan is a reformed urban planner with a passion for covering the Neo ecosystem. His objective as a writer for Neo News Today is to report news in an objective, fact-based, non-sensational manner. When not behind a computer screen, he can be found in the mountains rock climbing. Find Dylan on Twitter (@GrabowskiDylan).

More posts by Dylan Grabowski