Neo Global Development (NGD) has announced Flamincome, a dubbed as an “ultimate yield booster” on the Ethereum network that returns rewards to users on the Neo and Ethereum blockchains. Before the Flamingo token (FLM) mint rush period begins, users can start accruing rewards on the Ethereum blockchain by staking supported assets.

Additionally, Neo founder, Da Hongfei, will participate in an AMA from 2:00 pm – 3:00 pm (UTC) on Monday, September 21st via the official Flamingo Discord channel. Topics of conversation for the AMA will include the Flamingo protocol, the FLM token, and the upcoming Mint Rush.

Source: Neo Global Development

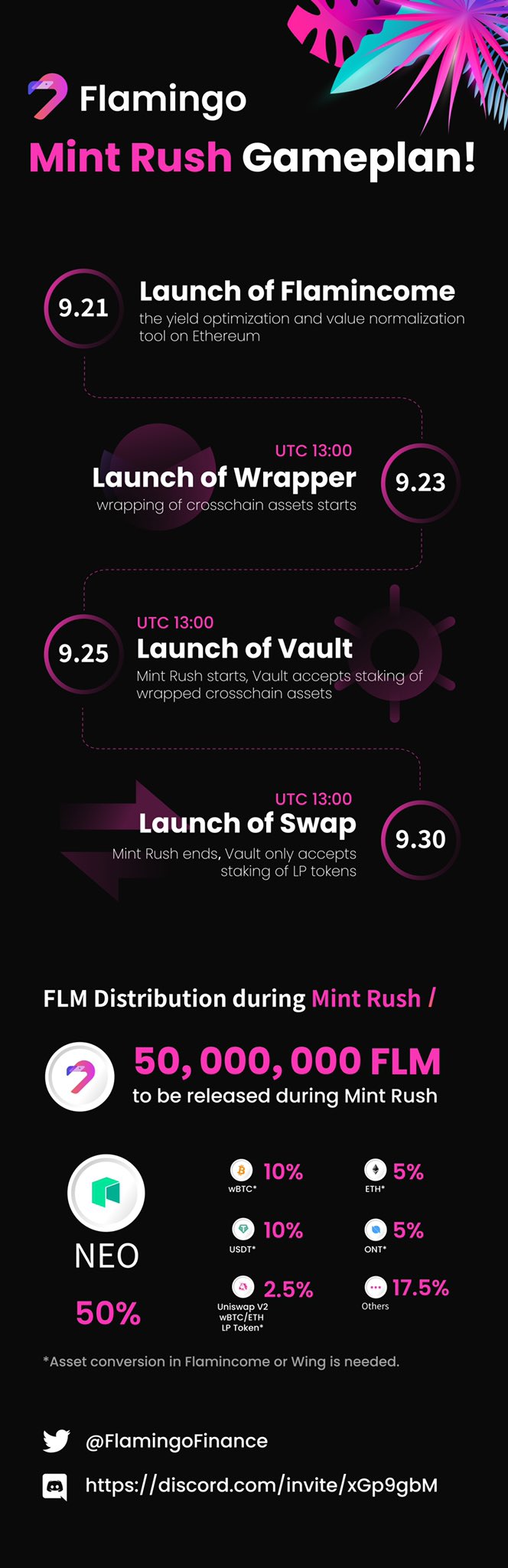

September 21st: Flamincome launch

Flamincome will operate similarly to Yearn Finance (YFI), a yield aggregator that utilizes lending services (i.e., Aave, Dydx, and Compound), applying strategies to optimize return yields for tokens staked to its platform. Tokens deposited on Yearn Finance are converted to yTokens and rebalanced for the most profitable lending services.

Like Yearn Finance, Flamincome will allow users to stake ETH, USDT, wBTC, DAI, and other ERC-20 tokens on the Ethereum network. Additionally, these ERC-20 assets will be converted to synthetic nTokens on the Neo blockchain, which can be used to earn additional yields. Flamincome aims to offer an “outward-growing” ecosystem by providing rewards on both Ethereum and Neo.

To minimize Ethereum user opportunity costs, Flamincome will provide an optimizer and normalizer. These modules will convert ERC-20 assets into wrapped assets for the Neo blockchain to stake via the Flamingo DeFi protocol.

Through the optimizer module, original Ethereum-based assets (e.g. ETH) will be converted to interest-bearing assets (e.g. fETH) following yield optimization strategies, similarly to Yearn Finance.

Through the normalizer module, the interest-bearing assets (e.g. fETH) will be converted to Neo-based synthetic assets (e.g. nETH), pegged at a 1:1 value with the original, underlying assets. Once wrapped via the normalizer, assets can be used on the Neo blockchain for further yield opportunities.

September 23rd: Wrapper launch

The Wrapper module is a cross-chain gateway with support for BTC, ETH, and ONT tokens, among others. Wrapper is intended to mint assets based on Neo’s NEP-5 token standard, making cross-chain assets available to Neo users and contracts.

The Flamingo contract only accepts NEP-5 assets, meaning each underlying asset – including NEO – must be converted or wrapped before using Flamingo. Once wrapped, as in the normalizer, the synthetic assets will maintain a 1:1 ratio with the original token value.

September 25th: Mint Rush begins

The Mint Rush for FLM tokens will begin at 1:00 pm (UTC) on Friday, September 25th, 2020, alongside the launch of the Vault’s first phase. The Vault is a “one-stop asset manager” to stake assets, mint synthetic collateralized stablecoins, and mine FLM. The Vault module will provide token swap functionality by hosting liquidity pools of various baskets of tokens.

Approximately 50 million FLM will be distributed to participants during the event. FLM can be earned by staking any of several underlying assets. Distribution rates vary depending on the asset, according to the follow distribution model:

- NEO (50% of FLM supply)

- wBTC (10% of FLM supply)

- USDT (10% of FLM supply)

- ETH (5% of FLM supply)

- ONT (5% of FLM supply)

- Uniswap V2 wBTC/ETH LP (2.5% of FLM supply)

- Others (17.5% of FLM supply)

At the time of press, there is no further information about the “Other” tokens that will be used in the initial Mint Rush.

September 28th: FLM Claims Begin

Flamingo participants will be able to claim their FLM beginning at 1:00 pm (UTC) on Monday, September 28th, 2020. In a conversation with Neo News Today, NGD iterated that participants must claim the credited FLM tokens from the Flamingo smart contract manually.

September 30th: Vault Phase Two launches, Mint Rush concludes

At 1:00 pm (UTC) on Wednesday, September 30th, 2020, the Mint Rush period will conclude, and the second phase of the Vault will launch in conjunction with Swap, an on-chain Auto Market Maker (AMM).

Phase two of the Vault will allow users to stake whitelisted tokens to receive Liquidity Pool (LP) tokens, entitling the users to collect trading fees.

During this phase, 80 million FLM will be rewarded over three weeks.

A step-by-step guide on Flamingo & Flamincome participation is expected to release in the near future.

About The Author: Dylan Grabowski

Dylan is a reformed urban planner with a passion for covering the Neo ecosystem. His objective as a writer for Neo News Today is to report news in an objective, fact-based, non-sensational manner. When not behind a computer screen, he can be found in the mountains rock climbing. Find Dylan on Twitter (@GrabowskiDylan).

More posts by Dylan Grabowski