Saffron Finance is a yield-generating peer-to-peer risk management platform and insurance fund. With Saffron, users can deploy cryptocurrency assets to gain exposure to a desired risk and return profile. Saffron Finance was the sixth project accepted into Neo N3’s Early Adoption Program.

The Early Adoption Program is Neo Global Development’s US $10 million initiative to encourage development and collaboration on N3, with decentralized finance (DeFi) as a key priority. The Saffron Finance team will receive grant funds, incubation opportunities, and technical support intended to enable its growth within the Neo ecosystem

Background

The DeFi space inevitably exposes participants to code-driven outcomes which are complex to navigate and can have significant negative consequences to an individual’s holdings. Focused economic attacks and incidents of extreme market volatility can lead to a severe loss of user funds and purchasing power.

Saffron Finance is aimed at alleviating this problem by narrowing the set of possible outcomes for liquidity providers. In doing so, Saffron leaders believe they are opening the door for traditional markets to migrate billions in yield-based financial products from traditional centralized institutions over to decentralized crypto markets.

Believed to be the first DeFi platform to implement tranched risk, since its launch Saffron has amassed over $50 million in Total Value Locked inside of its nearly two dozen asset pools. Tranching is a common risk adjustment concept in traditional finance, and is an important component of any sophisticated financial stack. Tranche, a French word meaning ‘slice’, describes a collection of assets which have been grouped based on various characteristics and sold to investors. Each tranche has its own maturity, credit rating, and yield.

The Saffron system is based on this concept, dividing earnings on the platform into different tranches with associated risk and return profiles. In essence, this builds out a solution for risk management inside of DeFi. As of November of 2021, the Saffron team had achieved strategic partnerships with 28 venture capital groups and angel investors, providing funding and TVL to the protocol.

Neo is one of two groups that have invested non-dilutive capital into the project, along with Solana. Psykeeper, the pseudonymous founder of Saffron, has attributed these partners as foundational to the project’s success. In addition to these collaborations, Saffron has protocol partners working closely with the team to integrate Saffron into other on-chain ecosystems.

Version 1 of the protocol was launched on Ethereum in Nov. 2020. Saffron Finance V2 went live on the Ethereum MainNet less than a year after the V1 release, with intentions to integrate several other chains, including Neo.

The new version of Saffron comes with several improvements over the V1 product. These include a more mobile-friendly interface, deposit caps on unaudited pools, and an auto-compounding feature to add yield earned back into a staking pool. Notably, in V1, staking was done according to two-week epoch periods. At the end of each epoch, users had to manually re-stake their tokens. Epochs have been removed entirely in Saffron V2 for a more convenient user experience.

The Saffron Ecosystem

Spice Token

Saffron Finance has a native token called Spice (SFI), which drives all of the products and incentive structures of the platform. The token has a maximum supply of 100,000 SFI, released via a predetermined schedule, with a 25% allocation to the team for sustained development purposes. According to popular token tracking sites, the circulating supply is currently around 80 to 90% of the total supply. Although SFI was originally created as an ERC-20 token, the team plans to bridge the token on to other chains. Polygon, Binance Smart Chain, and Solana are already supported. Neo users can look forward to a bridged token upon the platform’s integration with N3.

Minting of new SFI tokens is done as a subsidy to the various staking pools. After minting, the tokens continue to play an important role in Saffron. In order to access higher risk tranches, users must post SFI as collateral, to be used as an insurance fund to the lower risk tranches. In Saffron V2, SFI stakers also receive fees from all swapping and staking activity on the protocol. Additionally, ownership of SFI tokens grants a user the right to vote on governance proposals.

Pools and Adapters

The Saffron ecosystem includes a number of supported liquidity pools. Users can deposit assets to become liquidity providers. Through Saffron’s adapters, pooled capital is deployed onto external DeFi platforms to earn interest.

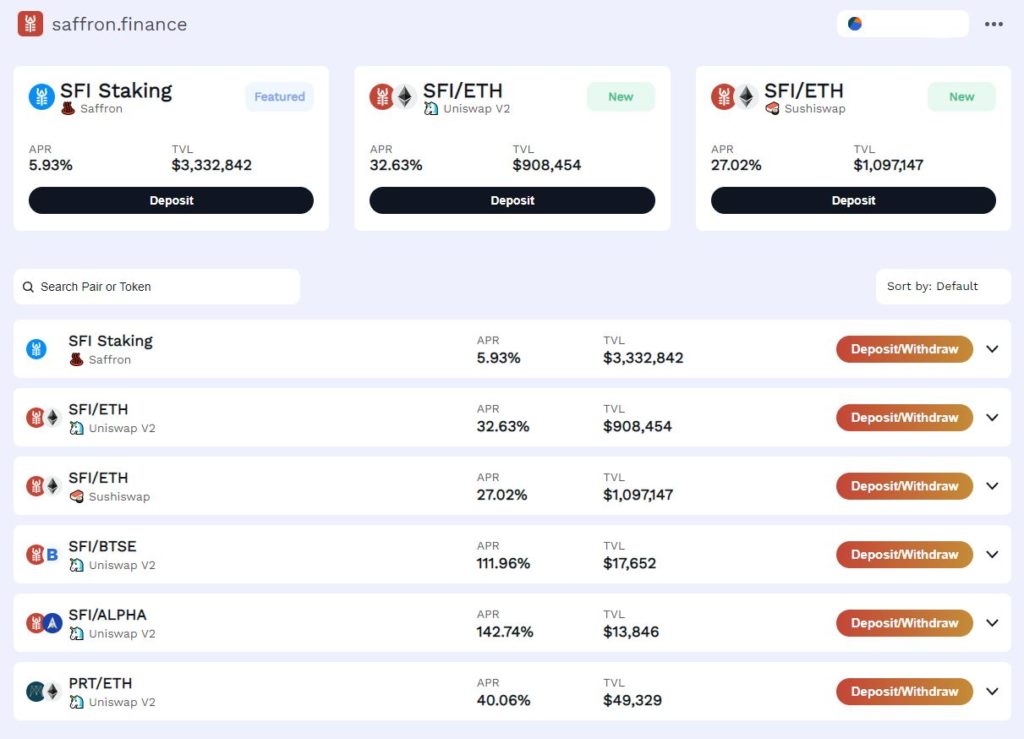

Currently, Saffron V2 users need to manually deposit liquidity via external platforms in order to receive Liquidity Provider (LP) tokens to be staked on Saffron. The image below shows the current interest rates, ranging from 27% to 143% depending on which pool liquidity is deployed to. Or, users can earn ~6% interest by simply staking their SFI holdings with Saffron. In all cases, interest is rewarded in SFI emissions.

Tranches

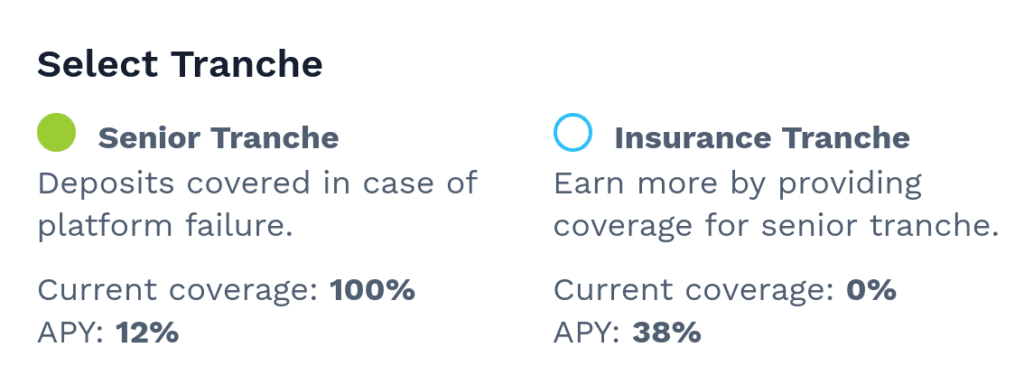

Although not yet available on Saffron V2, tranches are expected to go live in the near future pending the results of a security audit. The UI for selecting a tranche category can be seen in the image below, taken from a beta version of Saffron. For the launch, users can allocate their assets to one of two tranches: senior or insurance. However, additional tranches with different risk and return profiles may be added in future releases.

Senior vs Insurance Tranches

The senior tranche is lower risk, lower reward. Depositors will earn a yield on their holdings. However, the yield offered to the insurance tranche will be higher, due to the ever-present risk of a coverage event.

Assets held in the insurance tranche protect those in the senior. In the instance of a coverage event, such as the failure of a DeFi protocol, capital held in the insurance tranche will be used to cover any losses of the senior class.

The senior tranche requires users to deposit a liquidity provider token. These tokens can only be acquired by staking a token pair. Thus, any participant must necessarily have exposure to two assets. This is a risk in and of itself, as the price of each asset may fluctuate and subject the holder to impermanent loss.

The insurance tranche, however, is a single asset staking pool. Users must deposit a stablecoin. This pool may be of interest to those intrigued by the yields offered by DeFi protocols, but do not wish to stomach the volatility of cryptocurrency asset prices. By owning and staking a stablecoin, the dollar value of deposited assets will remain the same while earning a yield on the deposit.

Saffron users can evaluate their risk tolerance preferences and allocate their funds accordingly. With the Saffron V2 product doing away with epochs, participants can come and go into either tranche without the two week staking commitment.

Saffron on N3

Psykeeper has mentioned a desire to make sure Saffron could expand to the upgraded Neo N3. “Working with Neo N3 gives us an opportunity to provide risk reduced exposure to the new EVM alternative chains with large pools of capital. This expands the Saffron risk marketplace, while at the same time lowering the barrier to entry for DeFi across the board,” said Psykeeper, who also stated:

It’s in the best interest of Neo to have Saffron involved because we enable lower and higher risk for DeFi users, and likewise, it’s in the best interest for Saffron also because we are able to reach new areas of DeFi beyond the standard EVM chains. Besides, if we didn’t do this, someone else might fork Saffron and start their own Saffron-on-Neo without us!

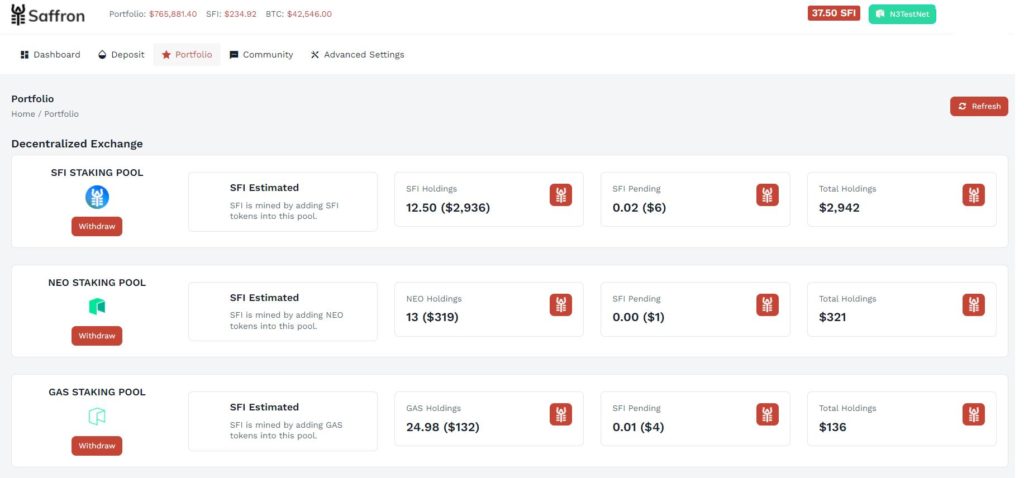

As part of the partnership with N3, the Saffron team plans to expand its staking and tranche protocols to Neo with its V2 product. The image below shows the UI for staking TestNet NEO and GAS on the Neo Saffron Beta product. The Saffron team is writing a program, as well as a Web3 app, for users to interface with Saffron directly on-chain.

View of TestNet NEO and GAS staking on the Neo Saffron Beta (source)

From Neo’s end, NGD leadership anticipates Saffron will become an important part of Neo’s presence in the DeFi landscape. John Wang, head of Neo Eco-Growth, stated:

We are pleased to have Saffron join the N3 Early Adoption program. Through Saffron, it will be possible to transfer billions of dollars of income financial products from centralized financial institutions to decentralized, open-source network. This unique ‘bridging’ role is significant for the entire Neo N3 ecosystem.

Readers can participate with all of Saffron’s features, as they become available, on the project’s website, and follow developments on its Twitter and Medium pages.

About The Author: Ryan Hasselbeck

Ryan is an aerospace engineer who ventured down the blockchain rabbit-hole and discovered that to be his primary passion in life. An observer of the Neo ecosystem for many years, Ryan felt a need to get involved and began contributing to Neo News Today. When he's not working, you can find him enjoying the outdoors, playing with his dog, or building and flying FPV drones.

More posts by Ryan Hasselbeck