Below is a translation of Da’s interview with Honeycomb Finance on the 8th of August, 2018.

The original article in Chinese can be found at the below link:

mp.weixin.qq.com/s/GoY1Xw8d03nz4VlimI7QfQ

Introduction:

“NEO had nothing at all. It was pure capital manipulation and market-making. Da Hongfei does not hold much NEO coins”. Earlier in July, these were the headlines following an audio-recording from Li XiaoLai, who spoke about one of the projects included in The National Tri-treasures of Public Blockchains (NEO, QTUM, GXChain), putting the NEO blockchain project under the FUD-limelight.

Though Da Hongfei was specifically named in the recording, he did not make a public response, which resulted in the turning of many heads. This brought up again the story of NEO being a “1000X coin” on a public blockchain, claiming that it does not perform well in the market, technical improvements are stagnant, and decentralization is lacking.

The controversy surrounding NEO and Da Hongfei does not stop there. Another project that is supported by the NEO ecosystem, Ontology (ONT) was also claimed to be in full-control by Da Hongfei.

All of a sudden, these FUD-headlines were all over the place – “NEO is dead”, “NEO’s development team has jumped-ship to Ontology”, “Da Hongfei used ONT for quick gains”.

Today, Da is with Honeycomb Finance for an interview, to address these headlines and also to share with us his strategies and thoughts for NEO in keeping it competitive as a public blockchain.

According to Da, NEO and Ontology are two completely independent teams. As the CEO of Onchain that incubated the Ontology project, he coordinates merely at the project’s strategy level, but does not dabble in the management of it and has freed himself as Ontology’s project advisor. Also, “NEO and ONT does not engage in market-making activities”, says Da.

Da explains that NEO originated out of China and when compared with all other public blockchains out there, it has a staunch global community involvement. He is also frank in sharing with us the challenges faced by NEO with regards to the imbalance in technical developments between domestic and international communities, and also compatibility issues surrounding NEO’s upgrade to 3.0.

Hence, to tackle the former challenge, NGD was established as the vehicle to recruit developers in order to strengthen the in-house technical team. On the other hand, tackling the latter challenge will be NEO’s upcoming main focus for the next half of the year, which includes publishing its Yellowpaper that will cover the technical specifications for NEO 3.0.

As a veteran in China’s public blockchain space, Da believes that the longevity of a public blockchain must come from a concrete vision and the eagerness for a high market-cap should not be long-term motivation factor.

About Ontology (ONT)

“ONT and NEO does not engage in market-making”

Honeycomb Finance: ONT has been in a free-fall. As its project advisor, what’s your opinion on the price decline?

Da Hongfei: Usually when people ask me about a rapid fall in a token’s price, my most common reply is that the price had previously gained too much. In a market that has no strong fundamentals or is being lacking in a matured pricing-model, emotions and sentiments become important pricing factors. On top of that, when a market has space for unrealistic imaginations, there exists unrealistic expectations. So when the token price goes up, positive expectations becomes self-reinforcing. With the entire market being in bad shape recently and token prices falling dramatically, levels of negative expectations, too, becomes very high and self-reinforcing.

A well-functioning market has properties of periodic fluctuations. In the entire development of human history, there has never been a smooth sail. The world operates in a wave-pattern, so it does not make sense to say whether price fluctuations are normal or abnormal.

The ups and downs in a market are normal. However, the fundamentals and pricing models in the cryptocurrency market are not as mature as secondary stock markets. This leads to a very emotionally-driven market.

My advice to investors is that, if cryptocurrency price movements significantly affects your well-being, I will suggest to not hold or invest in cryptocurrencies.

Photo of Da Hongfei

Honeycomb Finance: Many people were jumping onto the bandwagon buying ONT because of you. Now that the price took a heavy plunge, they are accusing you on cashing-out of the project for quick gains.

Da Hongfei: I am not directly involved in the daily operations of Ontology and also no longer a project advisor to it. My only impact on it is my strategy plannings as CEO of Onchain.

And buying ONT because of me? I don’t think I have so much influence. Before the first half of 2017, I was project advisor for a few other projects, such as NEX, Loopring, and Elastos. After that, I have abided closely to NEO’s public policy – founders and key personnels of NEO shall not hold any external positions as project advisors.

For the projects above, I do not hold their tokens anyway. As of now, I only have BTC, NEO, and ONT.

Cashing-out on a project is done through under-the-table techniques that will severely hamper a project’s valuation. Hence, NEO and ONT do not engage in these activities nor do we employ market-making measures, such as capital movements, price manipulation, or market liquidation. We simply do not hire such teams and do not allow any third party to manipulate our project’s valuation or to make our project’s market.

Honeycomb Finance: NEO and Ontology (ONT) seems to be very close to each other. Many think that Ontology is in fact NEO 2.0 and some even claimed that projects on NEO’s public blockchain, such as Ontology, are being developed by NEO itself. So, can you share with us some context of how things are between these two projects?

Da Hongfei: This is a major misconception. NEO’s development team is comprised of NEO Global Development (NGD) and other development communities around the world. The NGD organization is funded by NEO, which is mainly responsible for technical developments, marketing and business development. On the other hand, we have development communities with representatives from the United States and Europe – City of Zion, from Brazil – NeoResearch, from China – NEL, etc.

For Ontology, however, most of the developers are from the Onchain team. Therefore, both Ontology and NEO teams are independent of each other, have respective management teams, with no overlapping of human resource or cross-functional team members. Team fundings and capital injections are also very different – NEO is crowd-funded; Ontology is funded by more than a dozen institutional investors.

Honeycomb Finance: What about top-level management at NEO and Ontology? Do they overlap?

Da Hongfei: There is no overlapping of team members between NEO and Ontology. Erik Zhang and I are founders of NEO, while Li Jun is the founder of Ontology. Both projects have distinctive teams – the NEO team and the Ontology team (Ontology is an incubator project of Onchain). Erik and I only affect Ontology because we manage strategy planning at Onchain, but it is important to know that we are not directly involved in daily operations.

Ontology is in fact a public blockchain that focuses on the exchange of identity and data. One of the common denominators between Ontology and NEO is that they both share the same Smart Contract architecture, thus sharing a lot of similarities and being able to come together to form a much larger and more valuable ecosystem.

Also, Ontology is not NEO 2.0. On a different note, NEO itself has already started planning for the next upgrade – NEO 3.0.

About NEO

“Establishing NGD to tackle the imbalances between internal and external development”

Honeycomb Finance: NEO was founded in 2014. It crowdfunded a nice amount and market valuation was rather high. However, NEO kept a low-profile in the past year, leading to a shrink in market capitalization – how does NEO react to this? And how does NEO’s marketing strategy hold up to the bear market?

Da Hongfei: NEO did not deliberately maintain a low-profile. It was more towards the reason that our core development communities are abroad, so we spent more time internationally with them in those regions.

Earlier in 2018, NEO hosted DevCon 1 in San Francisco. At that conference, we saw over 600 developers from North America and Europe attend. Many brilliant new projects and prospective technologies were shared during that event.

Despite so, NEO’s main focus domestically in China was around Smart Contract development trainings and hackathons. The rationale behind these initiatives is that there are not many Smart Contract developers in China and we want to reverse the pattern where people only ask “how is the token’s price doing?”, which in the end turns into an investors’ Q&A.

I think our marketing strategy had nothing to do with the bear market. In this industry, there are countless media outlets and crypto-funds, and even more trading exchanges. To compare, NEO’s market activity is still relatively high.

Photo from early-2018, during NEO’s DevCon 1 at San Francisco.

Honeycomb Finance: As of 29th July 2018, NEO’s number of code upgrades and number of participants were 414 and 21 respectively, which falls far behind Ethereum, EOS, QTUM and even Ontology. Can you share with us on why NEO’s code update is slow and infrequent?

Da Hongfei: On the surface, it does seem that NEO’s code update is slow. This is because our development model is different from others. Beneath the surface, there are actually many community-driven projects. Many of them are based overseas in North America and Europe, and their Github repositories are detached from ours. Their codes sit in their own repositories and are kept separate from ours. Also, the reason NEO’s GitHub commits are not as much is because our team only pushes updates after we have completed enough components and features.

When China’s Center for Information Industry Development (CCID) evaluated blockchain projects and released their reports, their evaluation framework wasn’t the friendliest for NEO. We met to suggest whether it was possible to include our global community’s GitHub repositories as part of NEO codebase for the evaluation. In the end, we decided to keep things as it is and not change our existing development model for the sake of fitting into irrelevant evaluation frameworks.

Besides that, the statistics available on GitHub are known to to padded for analysis purposes. Even the price of having an extra “star” can be easily obtained from the market (stars represents the number of times a repository has been favorited by users). To put things into perspective, there are blockchain projects that claim to be the best in the world and have more applications than Ethereum. We are an experienced team and we understand what is going on in this industry. We believe that such practices of padding the statistics for analytics purposes are pointless.

Moving forward, NEO will issue monthly reports to update the public on our progress and will in the future include the work done by our global community into these reports.

Honeycomb Finance: How many team members are there on NEO’s development side?

Da Hongfei: Competition in the public blockchain space is fierce and many projects employ big development teams to stay ahead of each other. For NEO, we currently have 7 core developers, several dozens full-time community developers, and in the range of thousands of casual community developers. Out of the 7 core developers, Erik Zhang (who is one of NEO’s co-founder) and Li JianYing (who heads the development of compilers, a tool much used by developers) are based in China, while the remaining 5 are based remotely. Inside China, development talent is scarce and for this reason, we are putting more focus to recruit and cultivate potential candidates.

In addition, NEO does not want to convert its global development community into full-time team members and instead prefers to maintain active communities behind the project. Since NEO’s inception, our goal has always been dedicated to have communities support us in key areas of the project. For example, core developers will maintain and update our core protocol, understand global technical trends, such as challenges, progress and dynamics – then we align our strategy with them.

Honeycomb Finance: When we say that NEO’s technical updates are slow-moving, does it mean that the project is facing a bottleneck?

Da Hongfei: Though the overall development works at NEO is not slowing down, we acknowledge the challenge that there is an imbalance between internal and external developments. While external developments has been growing rapidly, we are slightly behind internally. External developments are usually focused on the peripheral components, which has limited impact on the core architecture. Hence, the core architecture and protocol is very much dependent on the internal team and as of now, it is not progressing as quickly as expected.

Therefore, NEO Global Development (NGD) was set up to address this issue. We want to recruit more developers and expand our operational capacity to bring more balance internally and externally.

Honeycomb Finance: In terms of technical competitiveness, how does NEO plan to stay of the of the game? Also, what are the focuses of current development?

Da Hongfei: We realize that NEO’s development process will start by us outlining the technical model, then we will base on that prepare a “Yellowpaper”, which will lay out the technical specifications. It will describe NEO’s protocol logic in natural and understandable language, then realize it by developing the computer languages, which are the codes. This is a very technical but pragmatic approach to move forward with large-scale developments.

Many projects out there have Whitepapers, but the ones with Yellowpapers are rare. So, for NEO, developing and releasing our Yellowpaper is our current priority until the end of the year.

Honeycomb Finance: In the DevCon1 conference back in February 2018, you set the vision for NEO to be the number one preferred blockchain by 2020. Based on the current development speed, is it still achievable?

Da Hongfei: It is still within reach because we are accelerating like clockwork. Don’t just look at the token price or market valuation, but look at other factors like technical development. Plus, NGD’s team capacity and capabilities has been expanding very quickly.

Honeycomb Finance: Investors are more concerned about the price of the tokens. What do you think NEO’s value will be in the future?

Da Hongfei: As we dive deeper into NEO 3.0, we start understanding new things and realize that it is actually a complicated process, especially on the technical matters. The overall idea surrounding NEO 3.0 is still under discussion. In spite of that, we will make careful adjustments together as a community, with the objective of keeping a very competitive edge in the next five years.

Honeycomb Finance: What are the advantages and disadvantages of NEO when compared to other public blockchains? Can you share with us more on the opportunities and threats?

Da Hongfei: In terms of the advantages, NEO is a project with a very clear vision, coupled with strong values that are embedded deeply within our team and our communities. With NEO, our vision is to realize an open network that serves the Smart Economy. In the blockchain space, there are many public blockchain projects, with variations in technical features and characteristics. But for all that, if the vision is not clear and solid, it will be just another public blockchain with a high market valuation, albeit a temporary one that will not stick around for long.

NEO’s competitive advantage also lies in its global development communities. If you look at other blockchain projects, a huge portion of communities are just made-up of investors. Besides that, NEO still has significant room for growth from a global perspective – the entrepreneurial environment and market in China is expanding exponentially.

In terms of disadvantages, it is understandable that Chinese entrepreneurs or community members will definitely face some challenges along the way, be it differences in values, cultural or language barriers. At the same time, they are commonly lumped together by aversions or unfair prejudices of Chinese communities when it comes to the topic of forgeries and imitations. Compared to the United States, China’s open-source culture is still somewhat behind. Besides that, talented programmers are rather employed by Alibaba, than contribute to an open-source community and receive rewards for their contribution.

Now, looking at one of our opportunities, I will say that out of China’s public blockchain space, NEO has the most international influence and participation. As for our threats, which I actually think of as challenges, they will primarily be NEO 3.0. It involves important topics such as the upgrade process itself, component compatibilities, and the ability of developers to adapt. I will say that this is the biggest challenge.

Honeycomb Finance: Through the establishment of NGC by NEO, has it been able to capture enough value in upstream and downstream areas of the blockchain industry?

Da Hongfei: I personally don’t think “capture” is the right term. It sounds like it is trying to control the market, which is a bit terrifying. “Investment” might be a more accurate term.

NEO has set up an independent investment vehicle, NEO Global Capital (NGC), to manage two fund units – the former is focused on supporting the NEO ecosystem and is not meant for profitability; the latter is for-profit and it has invested into a handful of other projects. NGC is registered in Singapore and it holds a venture capital management license. It currently manages assets of approximately $400 million to $500 million.

Honeycomb Finance: The public is convinced that NEO and Ontology are officially endorsed by The Ministry of Industry and Information Technology (MIIT) of the People’s Republic of China.

Da Hongfei: That is not true. The market is filled with fake-news and NEO has never mentioned such news anyway. We have a blockchain technical framework called Distributed Network Architecture (DNA), which has been submitted to MIIT for review and has concluded that it is certainly in-line with China’s guideline for blockchain frameworks. However, it is important to note that passing the review and having an official endorsement are two completely distinct and unrelated subjects.

About public blockchains

“Some public blockchain projects will not survive, but the space will carry on”

Honeycomb Finance: NEO’s vision to map real-world physical assets into digital assets on a public blockchain is also something that other projects aim to do. Based on your prediction, how much time will NEO need to make it happen?

Da Hongfei: It is difficult to make such a prediction. NEO’s vision is in fact to realize a Smart Economy; the current world that we live in is still an industrial economy.

Therefore, in the age of a Smart Economy, assets will be digitized and managed in a distributed and decentralized manner. At the same time, Smart Contracts will bind the rules and values of the assets on the blockchain, which ultimately reduces the cost of trust and increase business efficiency.

NEO aims to act as a technical-bridge to facilitate the integration of the real-world economy into the blockchain space and less as marketing tool. Our position is clear – to build and solidify our foundations, and to be well-prepared for the moment when the world is ready to migrate.

In the end, NEO’s ultimate goal is to deliver an open network that serves the Smart Economy, which we are still carefully planning for. To give an instance, there are a few ways we can go about it – we can maybe first integrate the real-world with the digital-space, or go on head first by building the digital-space (e.g. by having a digital-game ecosystem) and do the integration later.

Honeycomb Finance: At this point in time, there are more public blockchain projects than decentralized applications (dApp). Also, the cost for dApps to pick the right public blockchain is very high, because when the blockchain fails, the dApps that are developed on it will also follow suit. For this reason, some dApps came out to develop their own public blockchains. I wonder whether you have noticed this trend and what are your thoughts on this?

Da Hongfei: The chances of failing is bigger when you develop your own public blockchain. There are already functioning public blockchains out there, but when you have to develop your dApp and your own public blockchain, it is at least twice the work and the risk.

I can understand their rationale by doing so because of the market’s assumption that a public blockchain is able to fetch a high valuation. However, this assumption may eventually not hold and I, too, am doubtful about it. The analogy of it is like “I want to develop a game of my own, but I think ‘I might be using the wrong platform’, and Android and iOS are also unsuitable, so I will just develop my own operating system”.

Honeycomb Finance: How many dApps are there on NEO? Which ones are your favourite? And what types of dApps are still lacking? What suggestions do you have for ecosystem developers?

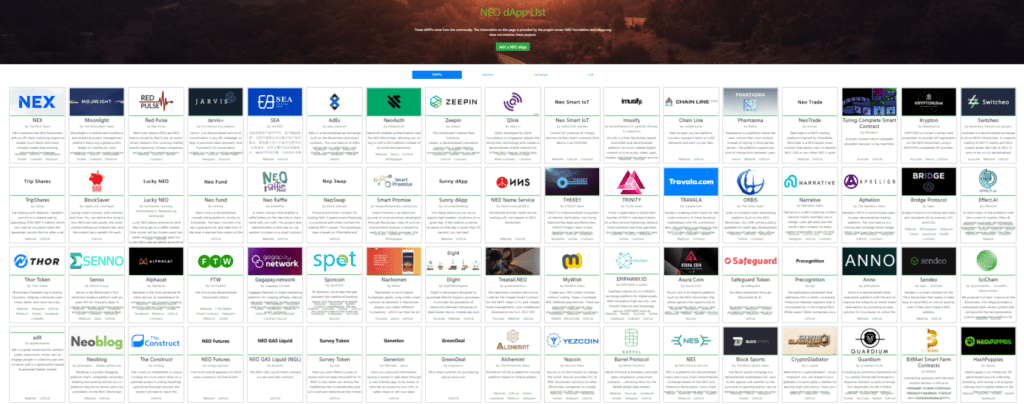

Da Hongfei: There are at least a 100 of them. You can check them out at www.ndapp.org. Plus, more than 60 dApps were deployed on nOS in recent weeks. nOS is another project that is being developed by one of our NEO communities in the Netherlands.

Image from ndapp.org, showing dApps developed on NEO.

My suggestion for ecosystem developers is to keep on developing interesting, seamless, and top-of-the-line games, and decentralized exchanges – these are more of what I hope to see. To provide some context, NEO is the only public blockchain out there that will never have a fork, which makes it very suitable for decentralized exchanges. On the flipside, dApps that are lacking would be stable tokens and games. As of now, games do not need to map the real-world, as physical assets are still not ready to be mapped into digital assets.

I want to advise developers to focus solving one problem at a time, because the success of a project is usually dependent on figuring out a core issue and not everything under the sun.

Honeycomb Finance: There are rumours in the space that public blockchains are going to die-off. Do you agree with this?

Da Hongfei: In the future, there is definitely no need for so many public blockchains – why do we even need so many of them? Because of the fact that public blockchain projects usually have a lot of space for imagination, they are able to fetch a much higher valuation that normally cannot be obtained from building blockchain applications.

Some public blockchain will not survive, but the space will carry on. The blockchain industry is quite different from the conventional stock markets, where it does not have a mechanism for delisting a project. Also, most blockchain teams usually do not have sufficient financial management skill sets and do not fully comprehend the concept of bankruptcy. Therefore, even if a project’s market valuation and liquidity shrinks to an unimaginable level, the blockchain will still remain in the space, and who knows, it may one day be reincarnated and may once again become a top-traded token in a bull-run.

Honeycomb Finance: Let’s assume the situation where most public blockchains projects die-off. What makes NEO an outlier of that event to survive that catastrophe?

Da Hongfei: NEO’s ecosystem development is very diversified and well-distributed across many countries. Plus, a single setback will not shake our team spirit; even if there was a series of setbacks, there are surely other catalysts that will push us forward.

Honeycomb Finance: In your view, what is the main factor that is currently withholding the use of blockchain by large-scale industries and enterprises?

Da Hongfei: At this point in time, there are many factors. Allow me to draw an analogy: what are the factors that limits a car to speed at 100 kilometers per hour? It might be that the engine is not complete, the road is not fully-tarred, the transportation rules are not set, the public’s acceptance level is still low – and as you can see, there are really a lot of missing factors for this car to speed-up.

Honeycomb Finance: Transactions per second (TPS) has always been used as an indicator of a high-performance public blockchain. So, does it really mean that the higher the TPS, the better it is? How can these be measured? And how much have NEO completed when we look at this factor?

Da Hongfei: If you look at blockchains from a particular perspective, they are of course better with higher TPS. Despite so, there are always trade-offs for a higher TPS. When implementing a high TPS blockchain, you must make sure that other factors within the system can keep up, i.e. storage capabilities. Nowadays, many blockchain projects use TPS as their marketing angle and making it their primary selling point. But if you really want to know how strong they are in terms of technical competencies, ask them for a live-test of their TPS.

In point of fact, TPS isn’t really the main factor. Except for Ethereum, which is most often congested, it is rare for most blockchains to have a transaction backlog. For industry experts, we know that the TPS-factor, for now, is not really that urgent.

To judge whether a blockchain is superior, one can look at a few other parameters – how much time will the blockchain need to get enough confirmations for finality, or how much time it will need to have a block that is 100% confirmed, or whether there is a risk of forking. Besides that, we can also look at the difficulty of developing smart contracts and the comprehensiveness of documentations.

Of all of the three points that I have just mentioned, NEO is still a little behind in terms of documentations and code specifications, which is why we are determined to make releasing our Yellowpaper our first and foremost priority in the following half of the year.

Honeycomb Finance: There is a saying in the Chinese blockchain community that the three treasures are NEO, QTUM and GXChain. What are your comments on the other two projects?

Da Hongfei: QTUM is different from NEO in a technical-sense. NEO is a completely written ground-up Smart Contract platform, while QTUM has somewhat technical similarities to Ethereum. As for GXChain, I am unfamiliar with it.

Essentially, there is no right or wrong when it comes to choosing your project’s technical development model, which is really dependent on your project’s timing and your team’s ability. But, for NEO, we have always adopted a unique design philosophy by building our proprietary technical architecture.

Honeycomb Finance: There are a number of digital currency mortgage lending platforms in the market and some of them are not even based on a blockchain. What are your thoughts on these non-blockchain based projects?

Da Hongfei: Not all projects require a blockchain. If you can operate without one, then it is fine too.

Honeycomb Finance: If it is not based on a blockchain, does it still consider to be a blockchain project?

Da Hongfei: It makes no sense to debate whether or not it is one. For example, if we look at a centralized exchange, it is not important to categorize whether it is a blockchain project, but we can all acknowledge the fact that it is the most profitable one. An exchange is also a very crucial component in the blockchain industry.

Honeycomb Finance: When technology giants like BAT or Facebook enter the blockchain space, should domestic blockchain startups or smaller teams be worried about competition such as buy-outs or acquisitions?

Da Hongfei: There is nothing to worry about. By logic, local Chinese telecommunications and information technology giants are already doing very well and small startups have no match for them when it comes to the availability of resources, but the tables have now turned.

Business models based on blockchain technology are the polar opposite of conventional business models employed by existing technology giants – data ownership now belongs to the users themselves. The fact that this is possible has significantly changed business model landscapes, putting existing business models in a very difficult position. This is the dilemma that every innovation will face – a winner will never maintain its competitive advantage forever, otherwise, the ecological balance within an ecosystem will be tipped-off and ruined.

About “Uncle Da (达叔)”

“My influence did not come from being a ‘XX-token whale’”

Honeycomb Finance: So, Uncle Da (达叔), what is your surname? What did you work as before you become an entrepreneur? There are some rumours claiming that you were once Ripple’s ambassador in China.

Da Hongfei: My surname is Dá (笪). I finished my college studies in Guangzhou and graduated from South China University of Technology, where I majored in Science and Technology. Upon graduation, I returned to Shanghai. I first came in contact with Bitcoin back in 2011. Before the year 2013, I managed my own higher education consulting firm. In 2013, I made the switch and started looking into the blockchain industry on a full-time basis.

As for being an ambassador for Ripple, that is not true. I first heard about Ripple when it was still in infancy stage and at that time, the Chinese Ripple community was almost non-existent and I think I was one of the earliest.

Honeycomb Finance: Not too long ago, an audio-recording from Li XiaoLai surfaced, claiming that “NEO had nothing at all. It was pure capital manipulation and market-making. Da Hongfei does not hold much NEO coins”. You never came out and responded to these claims. Do you want to do it now?

Da Hongfei: I can also claim that any token out there in the market is being manipulated, but how can it be proven to be factual or fictitious? Besides, that was a private recording by Li XiaoLai and I don’t think it is necessary for me to respond. XiaoLai is more of a radical individual. I have not connected with him for a quite some time. We probably met just once in the last three or four years.

As for how many tokens I hold, I am not prepared to disclose my personal information along with my financial situation. My influence, too, did not come from given titles such as “‘XX-token whale” or “holds X amount of tokens”. I will not respond to such queries.

Honeycomb Finance: What do you think of Li XiaoLai?

Da Hongfei: To me, Li XiaoLai is like a teacher who likes to share his personal social values. His sharings are usually very controversial from what the mainstream believes, forming opinions and discussions that generally have a split of two sides. After understanding and absorbing his sharings, you will feel like you have “torn down your existing social values and formed new ones”. However, I am not the biggest fan of his sharings, because when you look at the values that he has shared, he does not incorporate it in his walks of life.

Honeycomb Finance: Are there any books that gave you inspirations on community management and ecological systems design?

Da Hongfei: There’s a book called “Fooled by Randomness”, or in Chinese 《成事在天》. I read it before I became an entrepreneur. It left a very deep impression on me – it makes one better understand and more clearly identify the importance of opportunities, to become more humble, and easily embrace changes and uncertainty.

Honeycomb Finance: How do you spend your time nowadays and who do you spend it with? Were there any interesting topics that specifically caught your attention?

Da Hongfei: I spend most of my time with the NEO and Onchain team. I also had a chat with one of the earliest core team members from Alibaba a few weeks back. We talked about how they planned their strategies and made their decisions back in the early days. That was quite inspiring.

Honeycomb Finance: Had it not been for NEO, have you ever thought about what you would be doing?

Da Hongfei: I might open a restaurant that blends a mix of cultural influences and tastes, or maybe even host an electronic music festival.

Honeycomb Finance: After achieving financial freedom, what changes have you made to your lifestyle?

Da Hongfei: It mainly gave me a sense of security and to not be pressured by life. I am also no longer bound by my short-term goals and enjoy freely taking up new challenges myself. Lifestyle-wise, there hasn’t been any major changes, as I’m still living in the same apartment that I have lived in since seven or eight years ago.

Honeycomb Finance: What questions do you try to avoid from the public?

Da Hongfei: They ask me how many tokens do I hold. I think this is the same as asking how much savings do you have.

Honeycomb Finance: You should have quite a bit of tokens. Don’t you need to hire a bodyguard?

Da Hongfei: Only those who owe people money will need bodyguards. Besides, the tokens are not with me. You will require more than my individual private key.

Honeycomb Finance: Are there different factions within the crypto-community? Are you closer with anyone in particular?

Da Hongfei: I don’t know any factions, nor am I invited to join any of these. I am more individualistic and not tied to anyone in particular. I just meet with everyone during events and we do our own work. These are also the values within my organizations.

Honeycomb Finance: Do you participate in the Big Brothers’ Circle? Like sitting at the roundtable and socializing with the likes of Li LinXu.

Da Hongfei: No, I do not. Maybe I’m not that capable yet.

Translation by Aaron Hong

About The Author: Contributor

More posts by Contributor